My Pay

Reviews:

0

Category:

Personal finance

Description

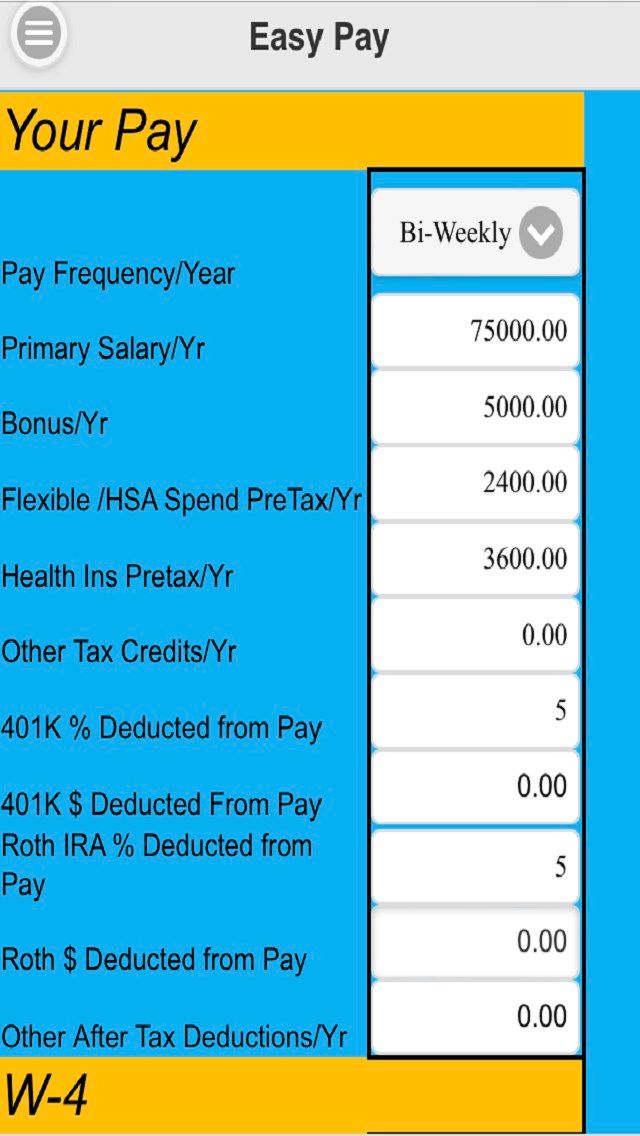

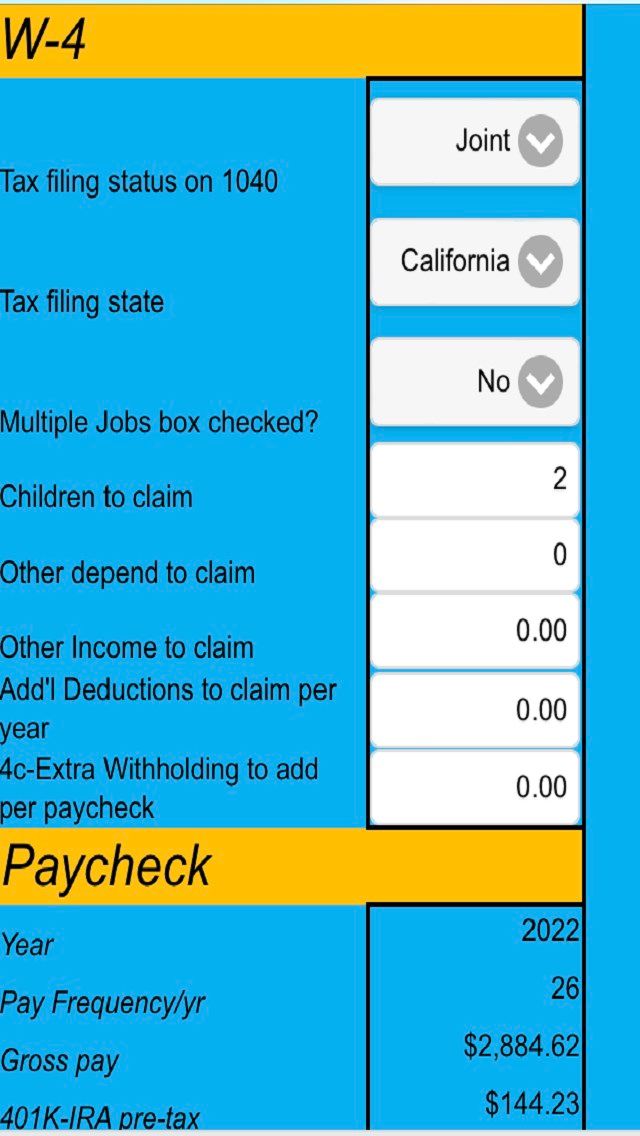

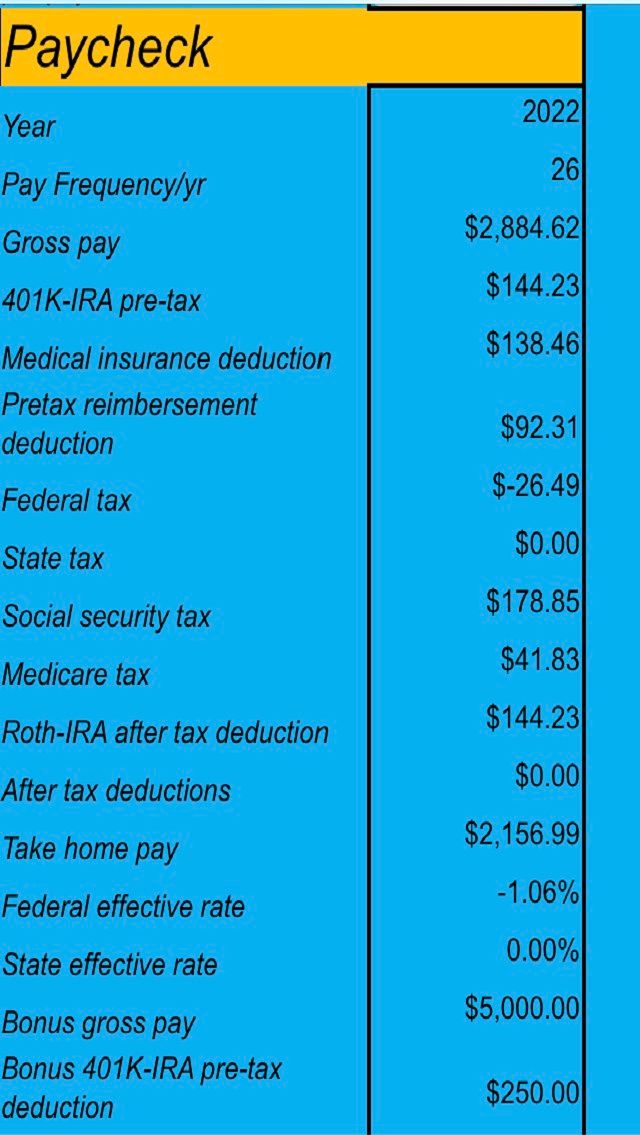

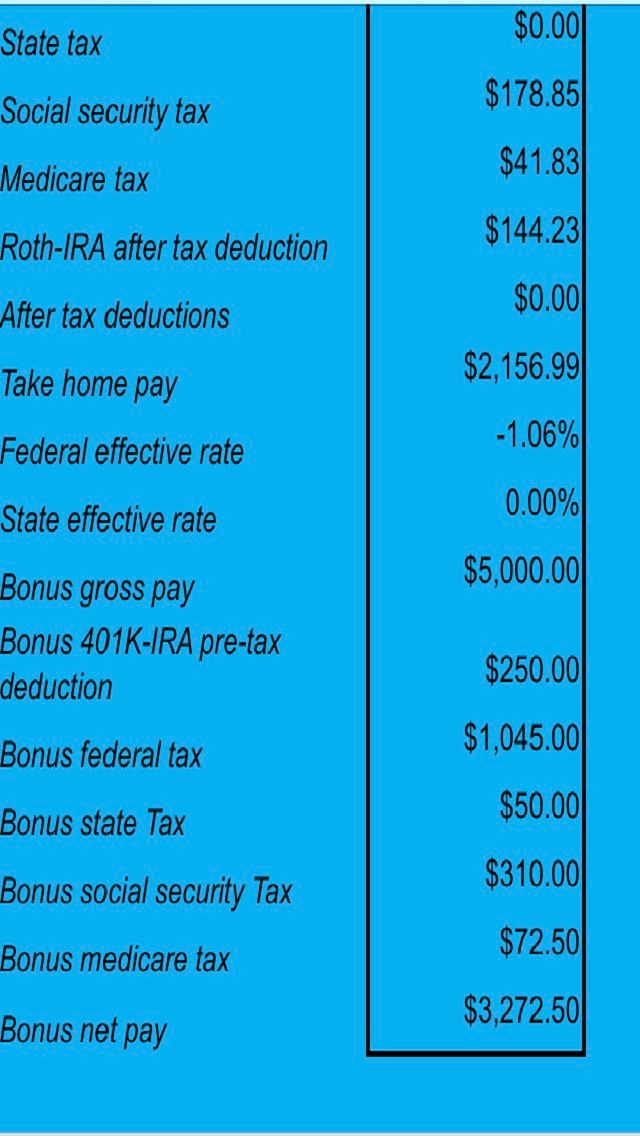

Calculates the components of your paycheck depending upon how you filled out your W-4. Includes the W-4, State taxes (All 50 states and D.C), Federal taxes, Social Security, and Medicare taxes. Also calculates the taxes of a bonus.

-

Paycheck Calculator

-

W-4

-

Components of your Paycheck

-

Includes all 50 states and D.C.

-

Calculates 2020 Federal and State Withholding

Product ID:

9NGV81VDGB85

Release date:

2022-03-22

Last update:

2023-03-04