Paycheck2020

Reviews:

0

Category:

Personal finance

Description

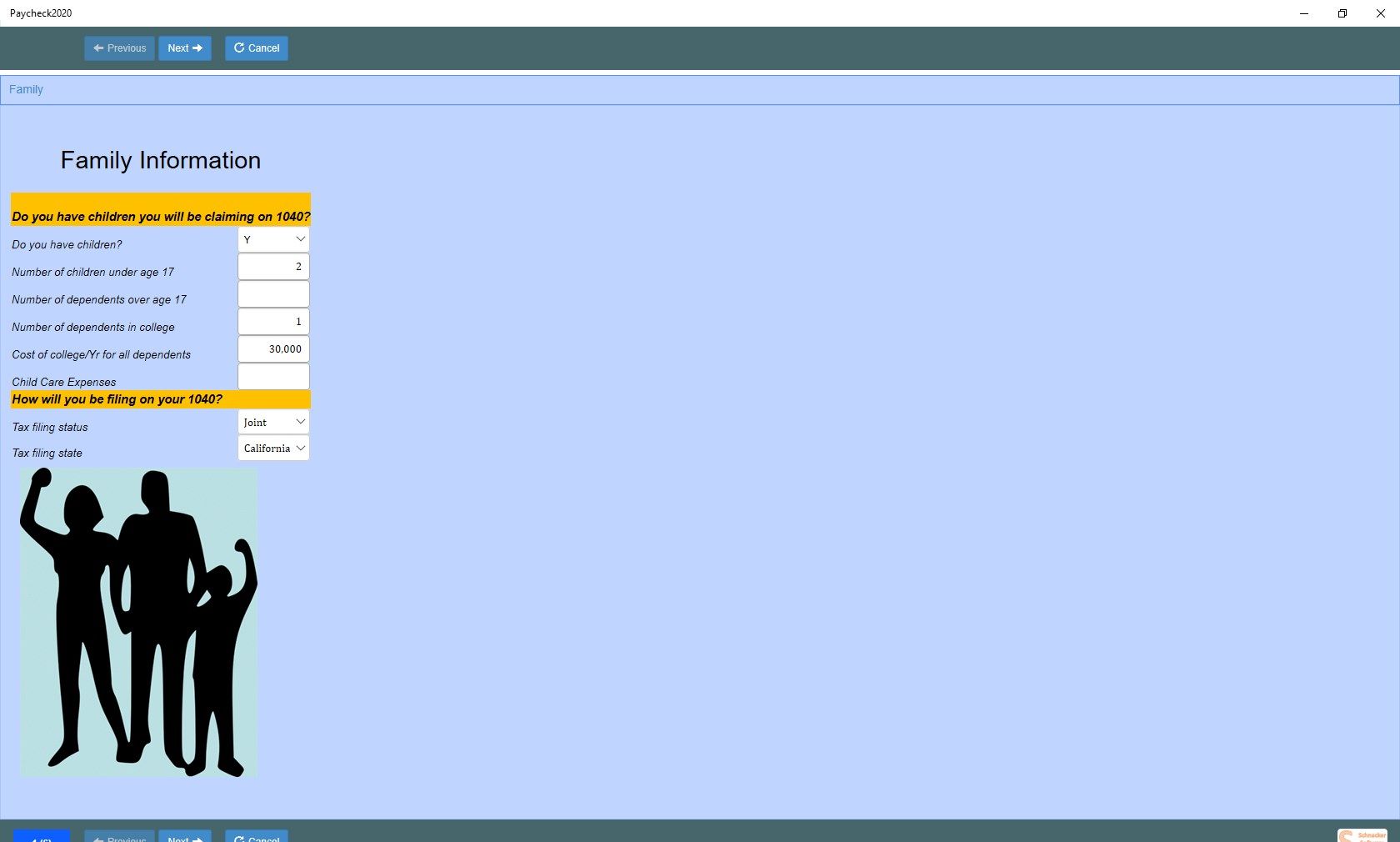

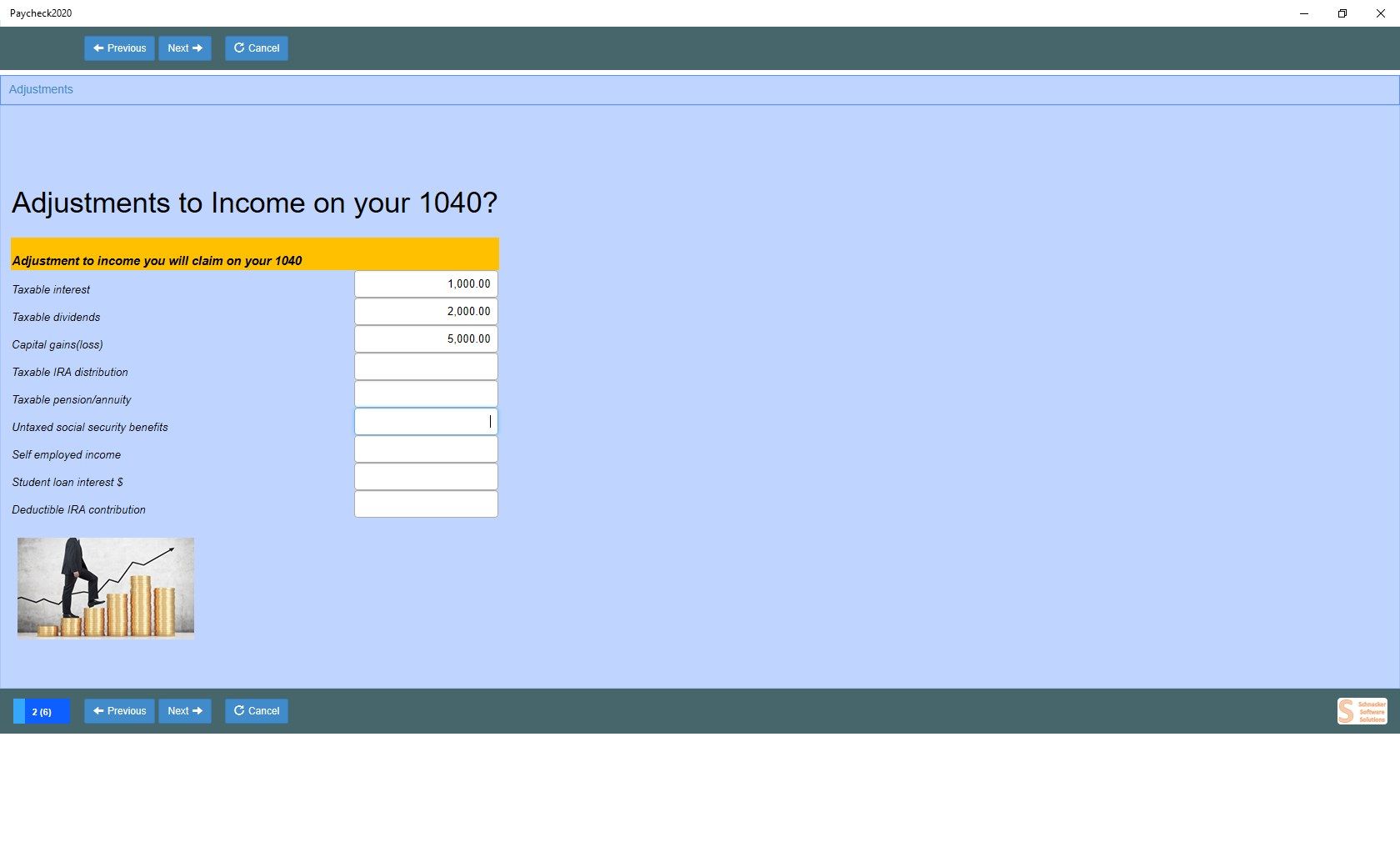

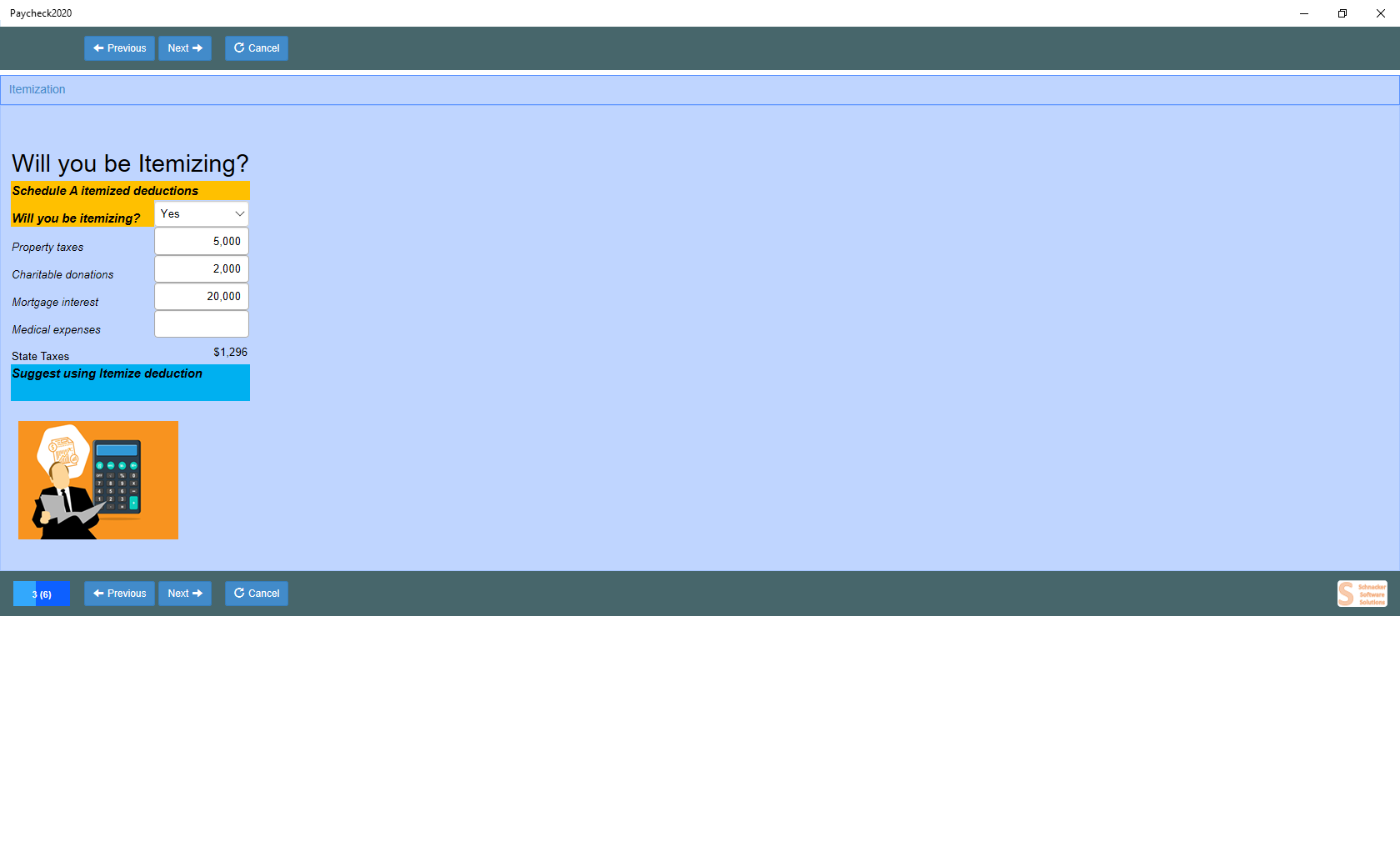

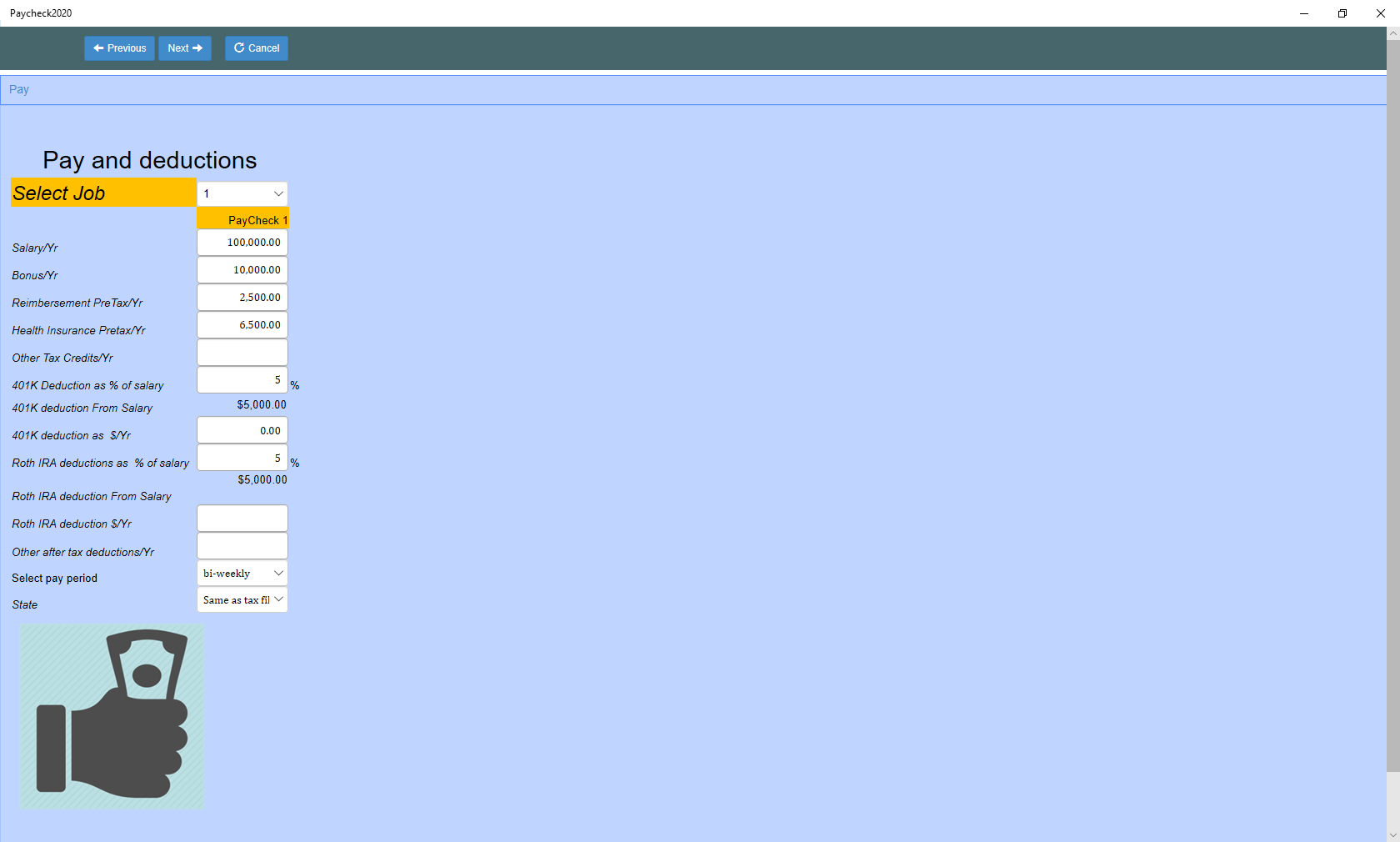

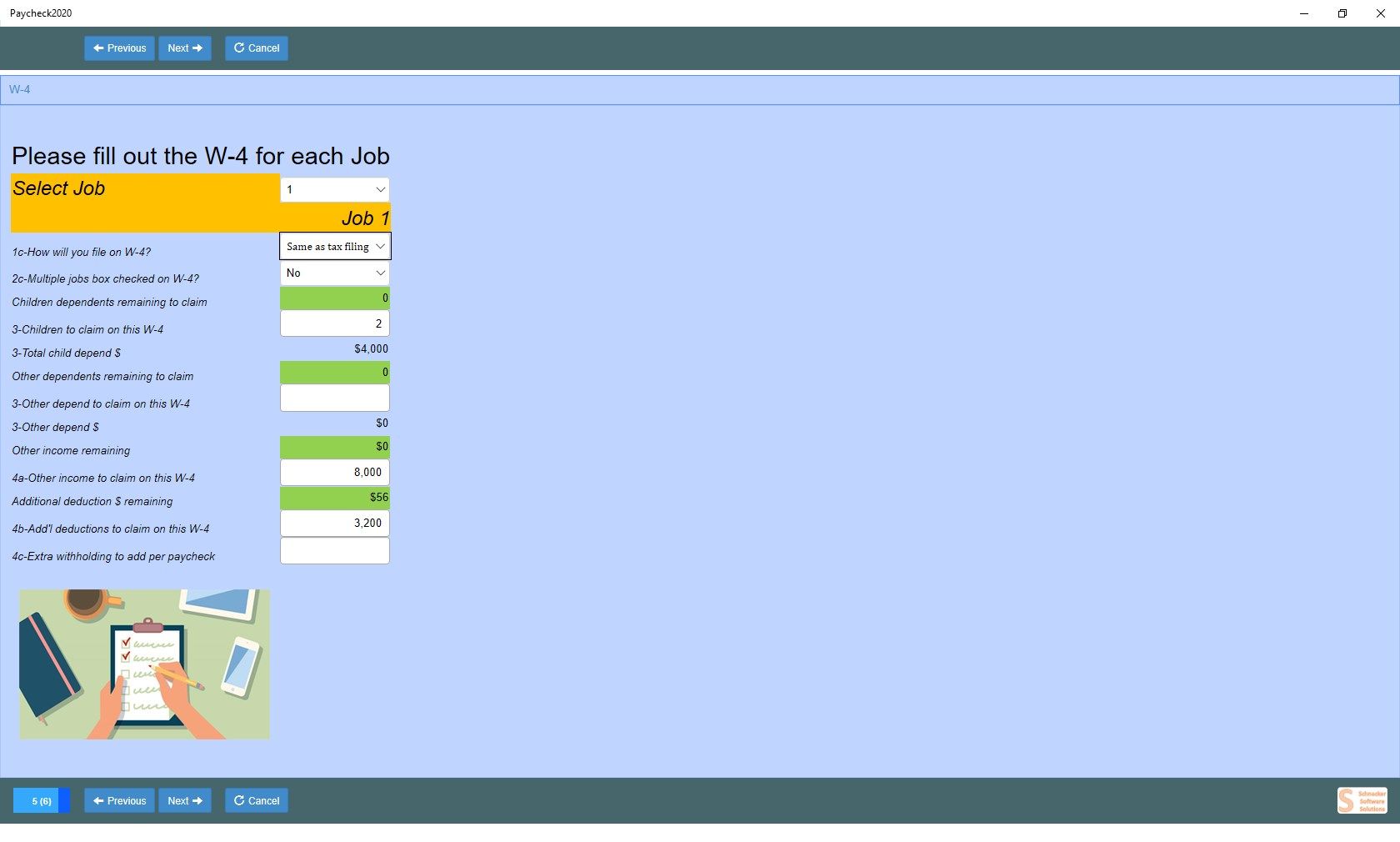

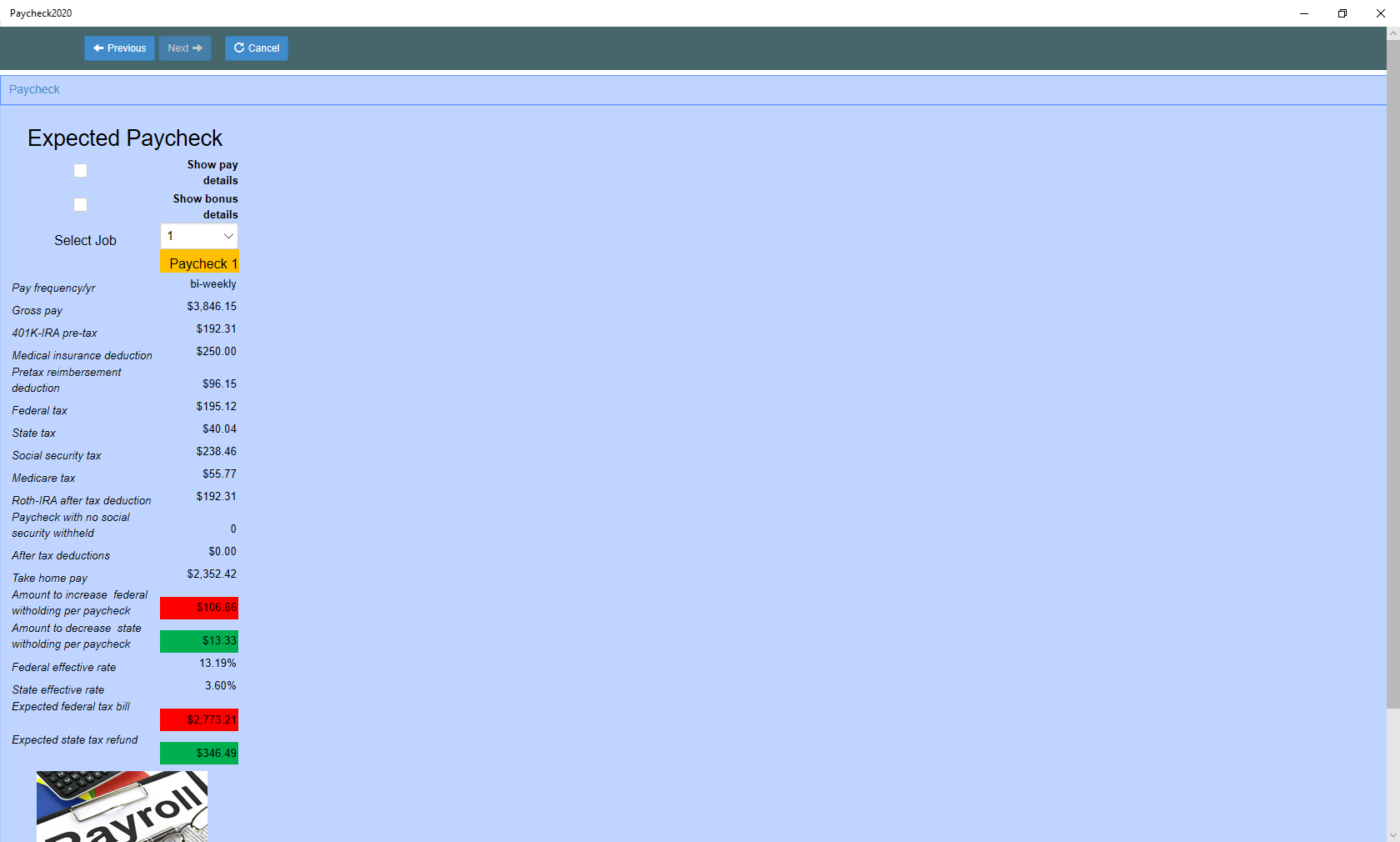

Paycheck 2020 determines your paycheck’s net pay by calculating Federal and State taxes and taking into account Pre and Post Tax deductions. Paycheck 2020 includes your tax filing status, your expected income adjustments and your expected itemizations to lead you through the complicated 2020 W-4. Paycheck 2020 allows you to enter up to 4 paychecks and compare the expected withholding of each paycheck to the calculated income taxes to determine the expected tax bill or refund at the end of the year.

-

Estimates Net Pay

-

Calculates State and Federal Taxes and Withholding

-

Includes tax filing information, income adjustments, and itemizations

-

Guides you through the 2020 W-4

-

Calculates how much more/less to withhold per paycheck

-

Calculates end of year tax refund/bill based upon withholding

-

Calculates withholding and taxes for up to 4 paychecks

Product ID:

9NZJ55Q014B6

Release date:

2020-05-09

Last update:

2023-03-05