Description

QuickBooks Pro 2017, the premier small business accounting software, is designed to help small businesses manage product inventory, sales, invoices, company payroll, and countless other aspects of running a business. Professor Teaches QuickBooks 2017 is computer training software designed to teach you the ins and outs of Intuit QuickBooks Pro 2017. This hands-on, interactive course will provide everything you need to know about the fundamentals of QuickBooks Harness the power of QuickBooks 2017 to help your business grow.

Professor Teaches QuickBooks Pro 2017 Training will Teach You How To:

• Track sales

• Track expenses

• Enter customer payments

• Create invoices and forms

• Accounting Basics

Our Extensive Computer Training Course Covers the Following Topics:

• QuickBooks Fundamentals

• Setting Up Lists

• Creating Items

• Entering Transactions for Incoming Funds

• Entering Transactions for Outgoing Funds

• Maintaining Financial Information

• Working with Reports

Course Outline

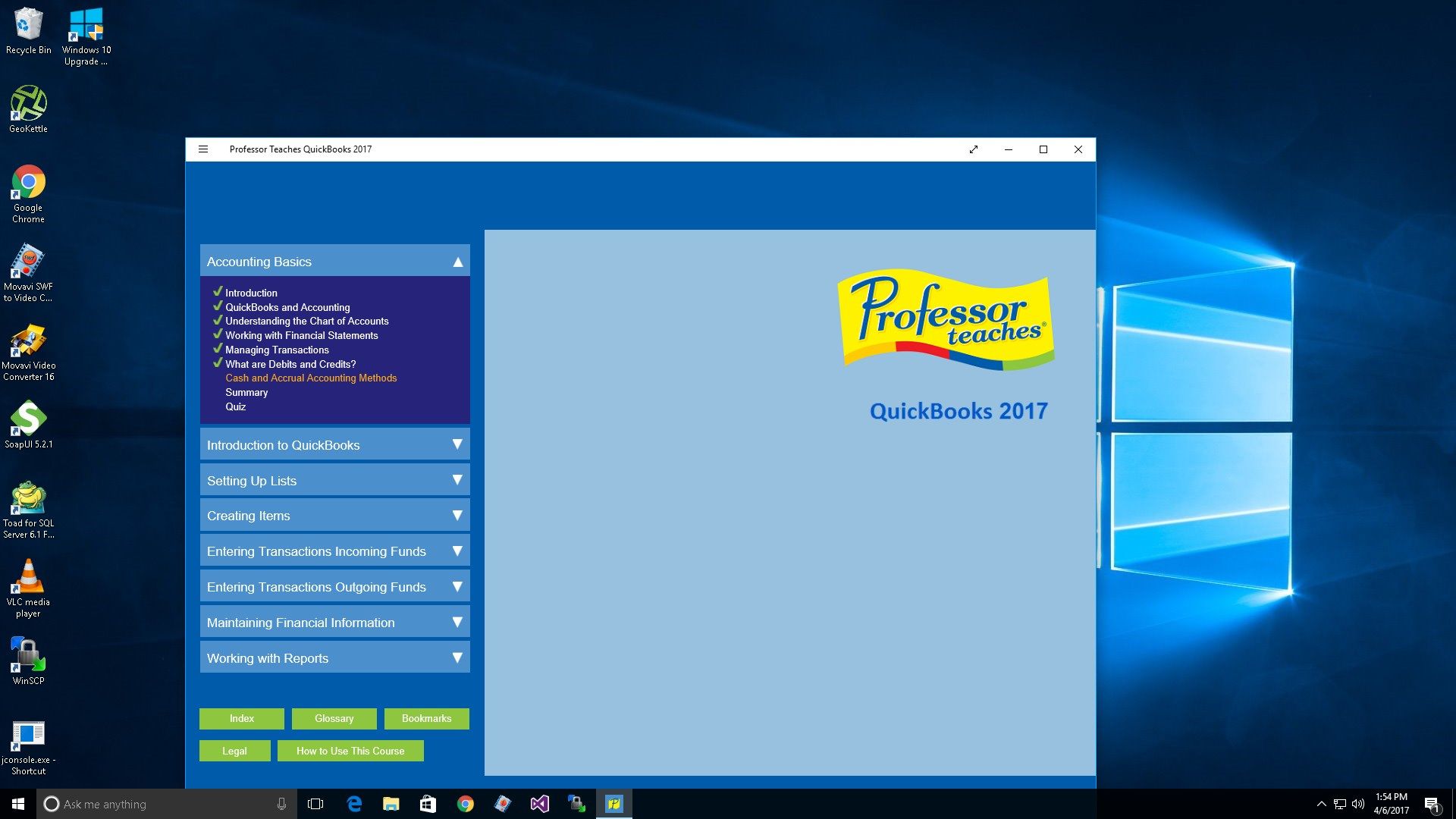

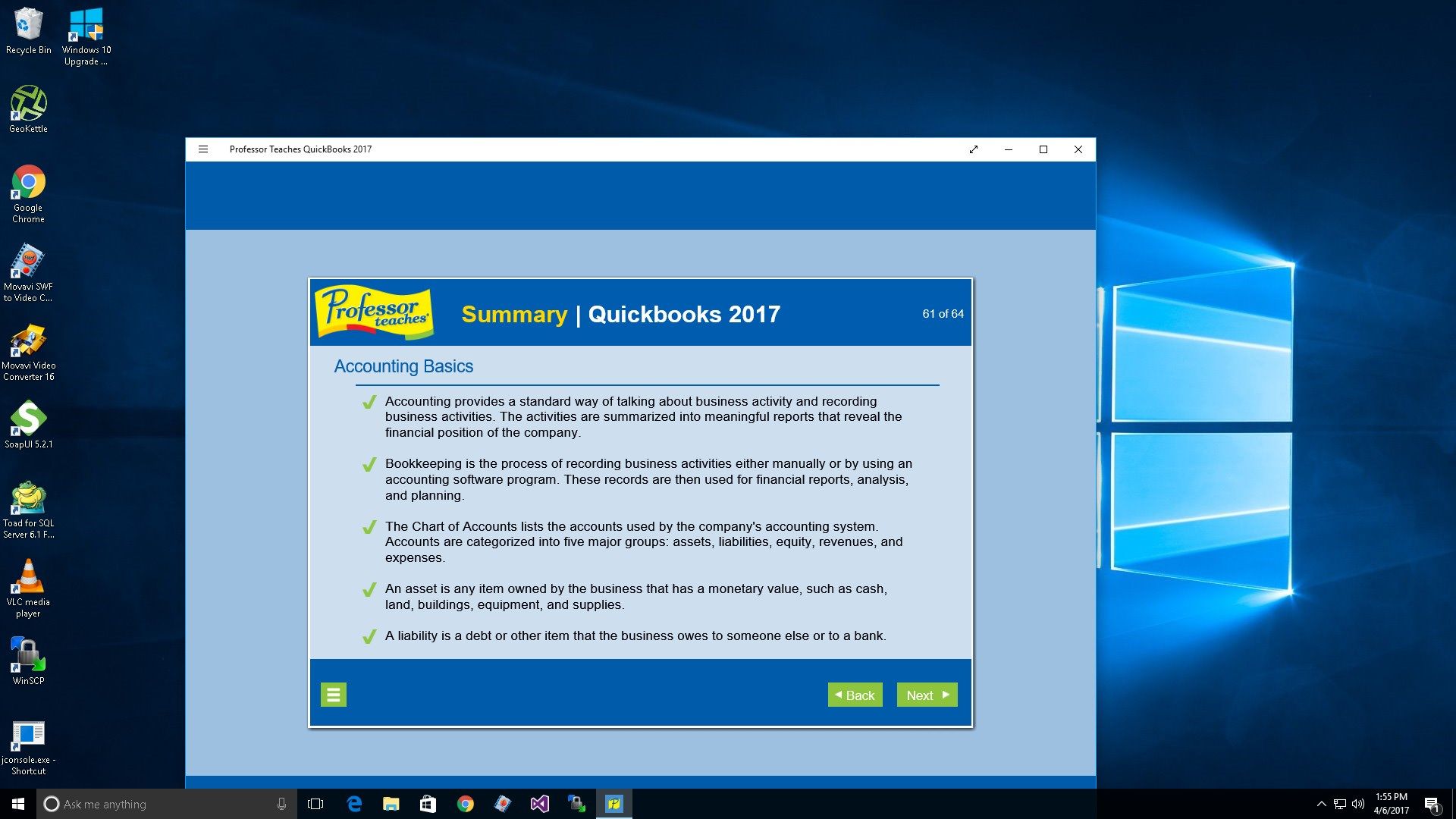

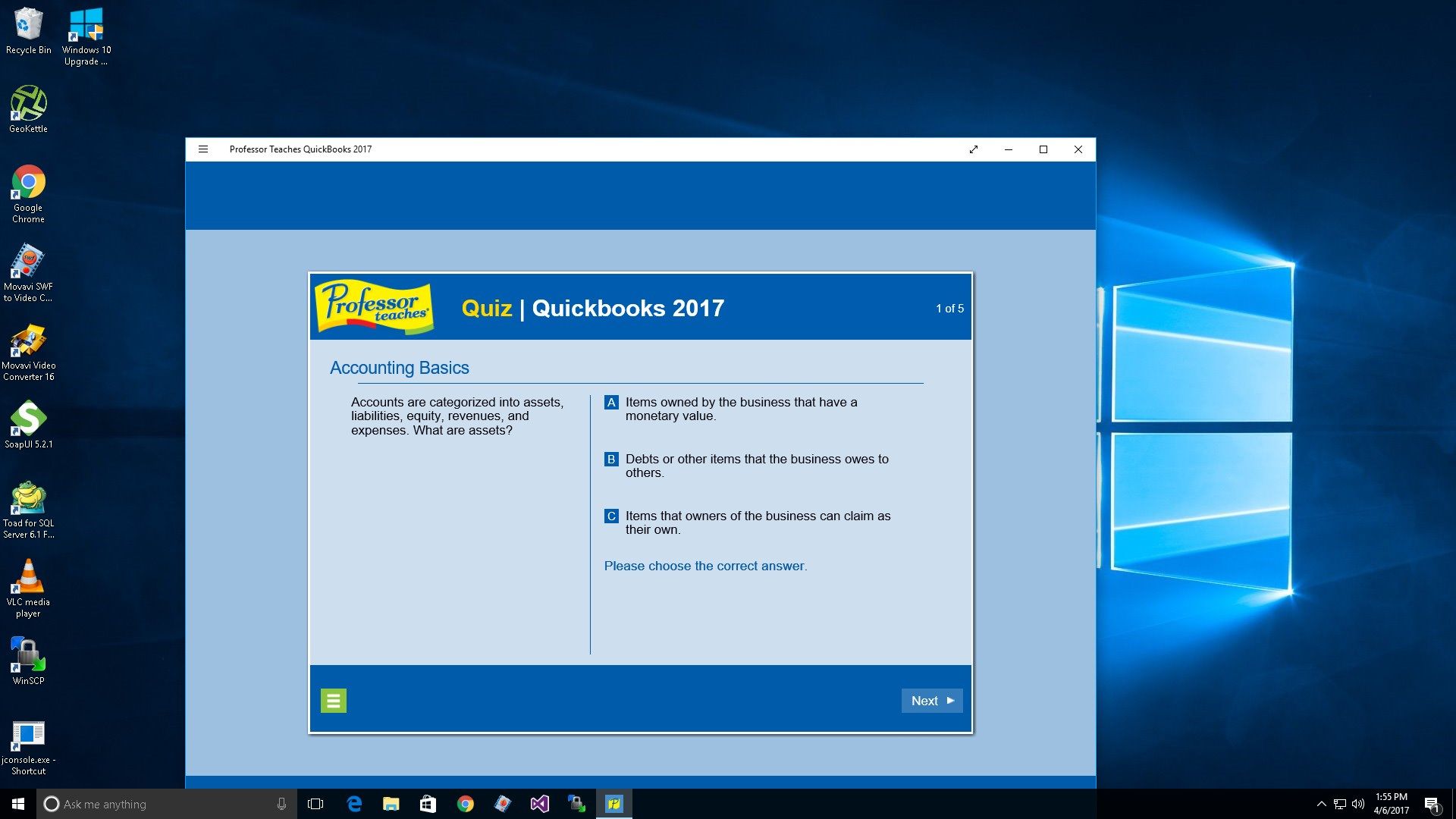

Chapter 1: Accounting Basics

• QuickBooks and Accounting

• Understanding the Chart of Accounts

• Working with Financial Statements

• Managing Transactions

• What are Debits and Credits?

• Cash and Accrual Accounting Methods

Chapter 2: Introduction to QuickBooks

• What is QuickBooks?

• Overview of QuickBooks Tasks

• Starting QuickBooks

• Creating a Company File

• Specifying Features for Your Business

• Understanding the Home Page

• Navigating QuickBooks

Chapter 3: Setting Up Lists

• What are Lists?

• Building the Chart of Accounts

• Entering Opening Balances

• Adding Customers

• Adding Jobs

• Adding Vendors

• Understanding Attached Documents

• Using the Document Center

• Understanding the Employee List

Chapter 4: Creating Items

• What are Items?

• Adding Items for Products

• Adding Items for Services

• Reviewing Other Items

• Adding Sales Tax Items

• Working with Timesheets

Chapter 5: Entering Transactions for Incoming Funds

• What are Transactions?

• Understanding the Incoming Funds Workflow

• Creating Invoices for Products

• Creating Invoices for Services and Products

• Viewing Changes to the Chart of Accounts

• Receiving Payments

• Making Deposits

Chapter 6: Entering Transactions for Outgoing Funds

• Understanding the Outgoing Funds Workflow

• Entering Bills

• Including Timesheet Hours on Bills

• Paying Bills

• Writing Checks

• Printing Checks

• Using the Check Register

• Banking Online

Chapter 7: Maintaining Financial Information

• Reconciling Bank Accounts

• Making General Journal Entries

• Printing Forms

• Backing Up and Restoring Data

• Setting QuickBooks Preferences

• Getting Help

• Exploring Intuit Community

Chapter 8: Working with Reports

• Overview of the Report Center

• Understanding the Balance Sheet

• Reviewing the Profit and Loss Statement

• Generating Report Graphs

• Viewing Customer and Vendor Reports

• Using Report Templates

• Customizing Reports

• Memorizing Reports

• Using Company and Customer Snapshots

• Using Calendar View

• About the Lead Center

-

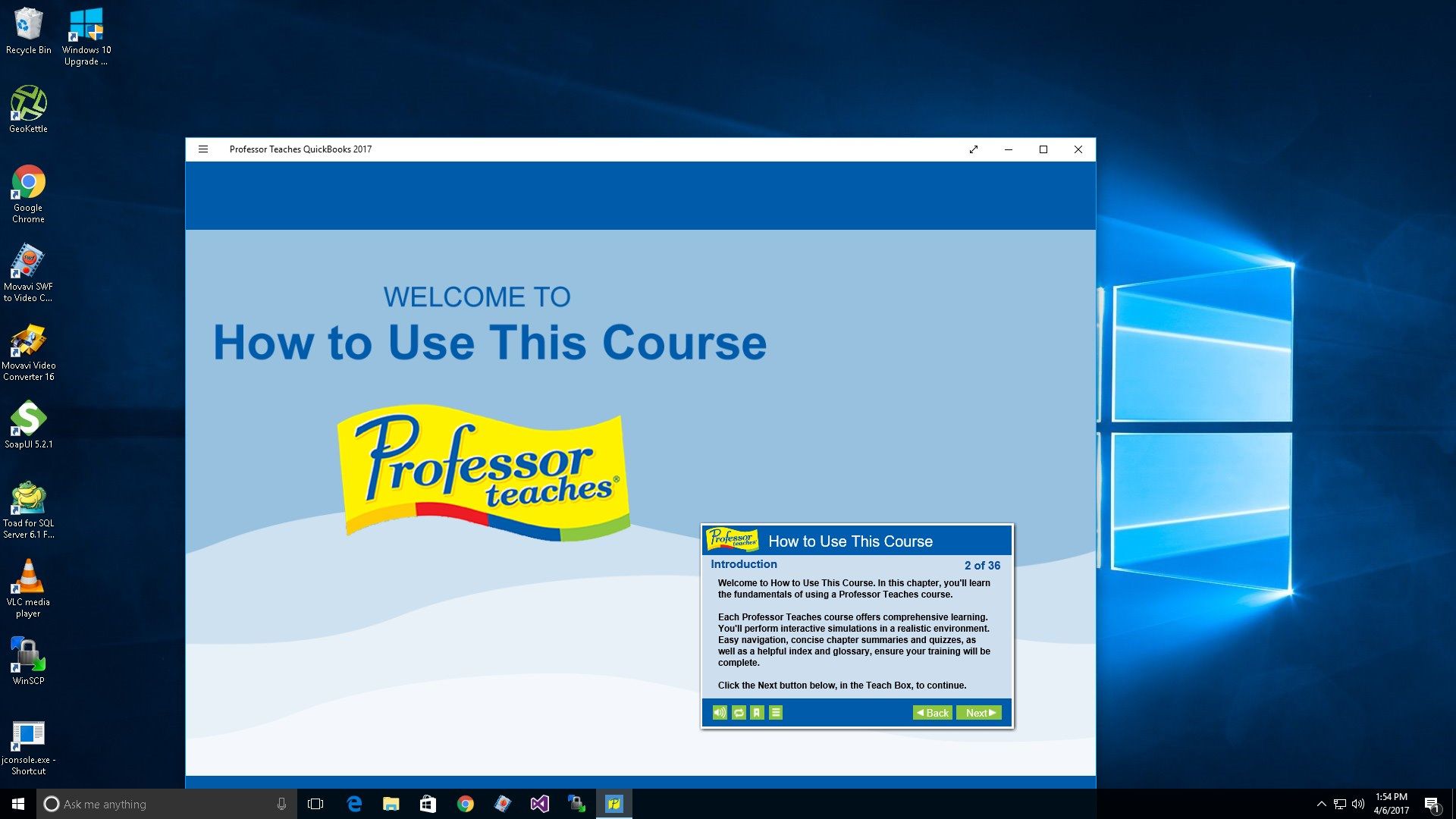

Practice in a Realistic Simulation of the Software

-

4 to 8 Hours of Training per Course

-

Beginner to Advanced Topics

-

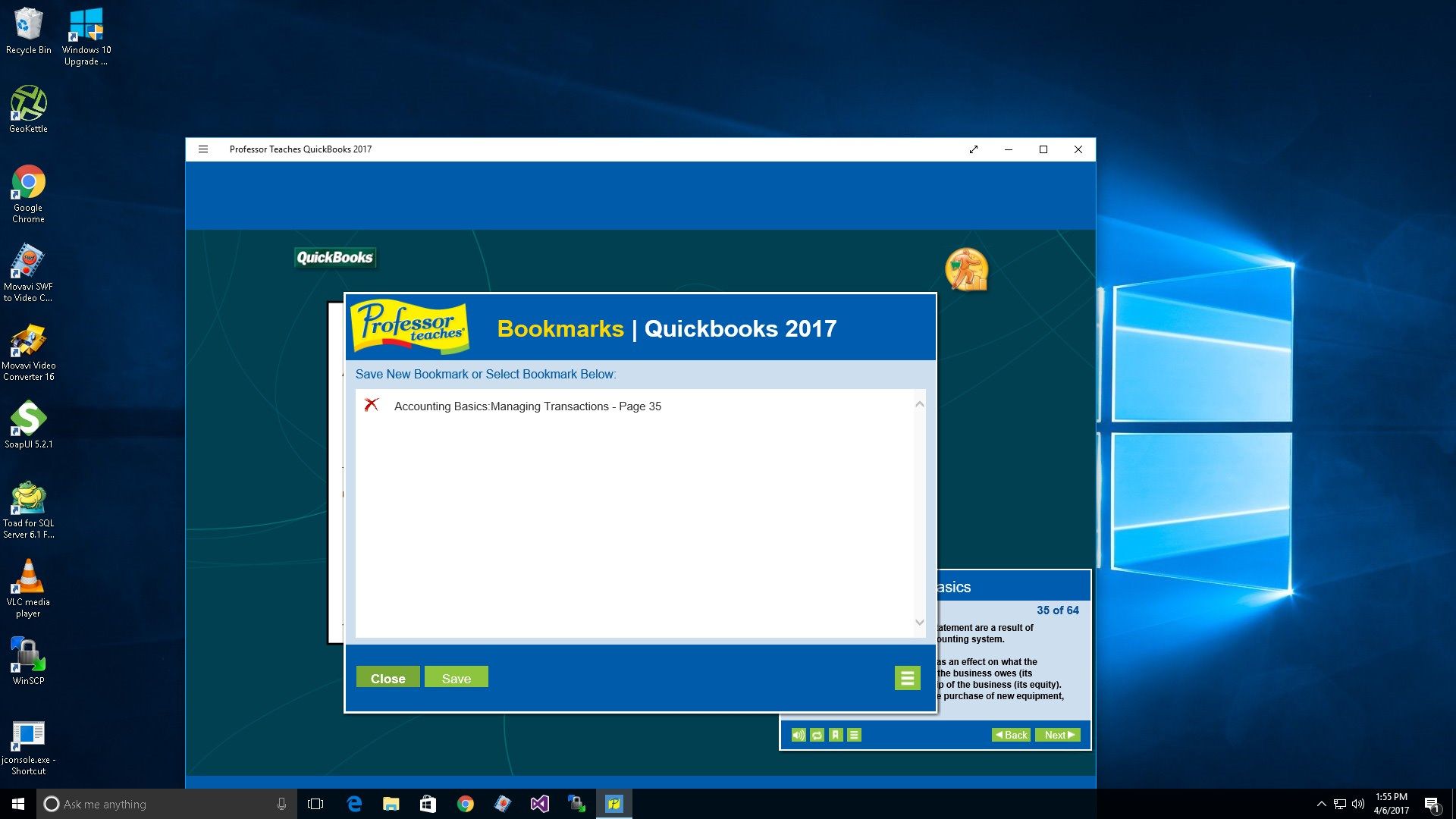

Self-Paced Learning Objectives

-

Professional Voice Narration

-

End-of-Chapter Quiz Questions

-

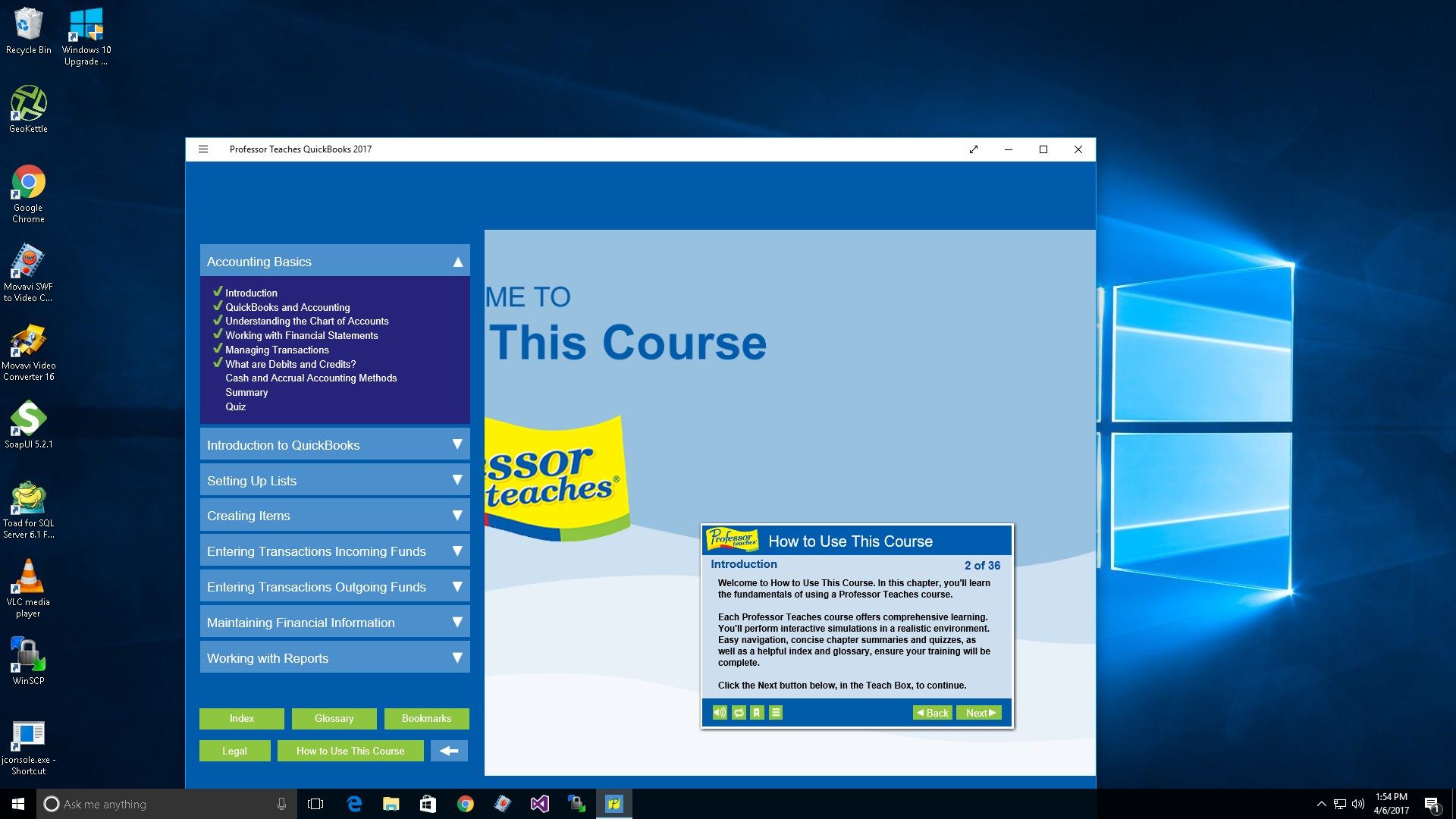

Checkmarks for Completed Topics

-

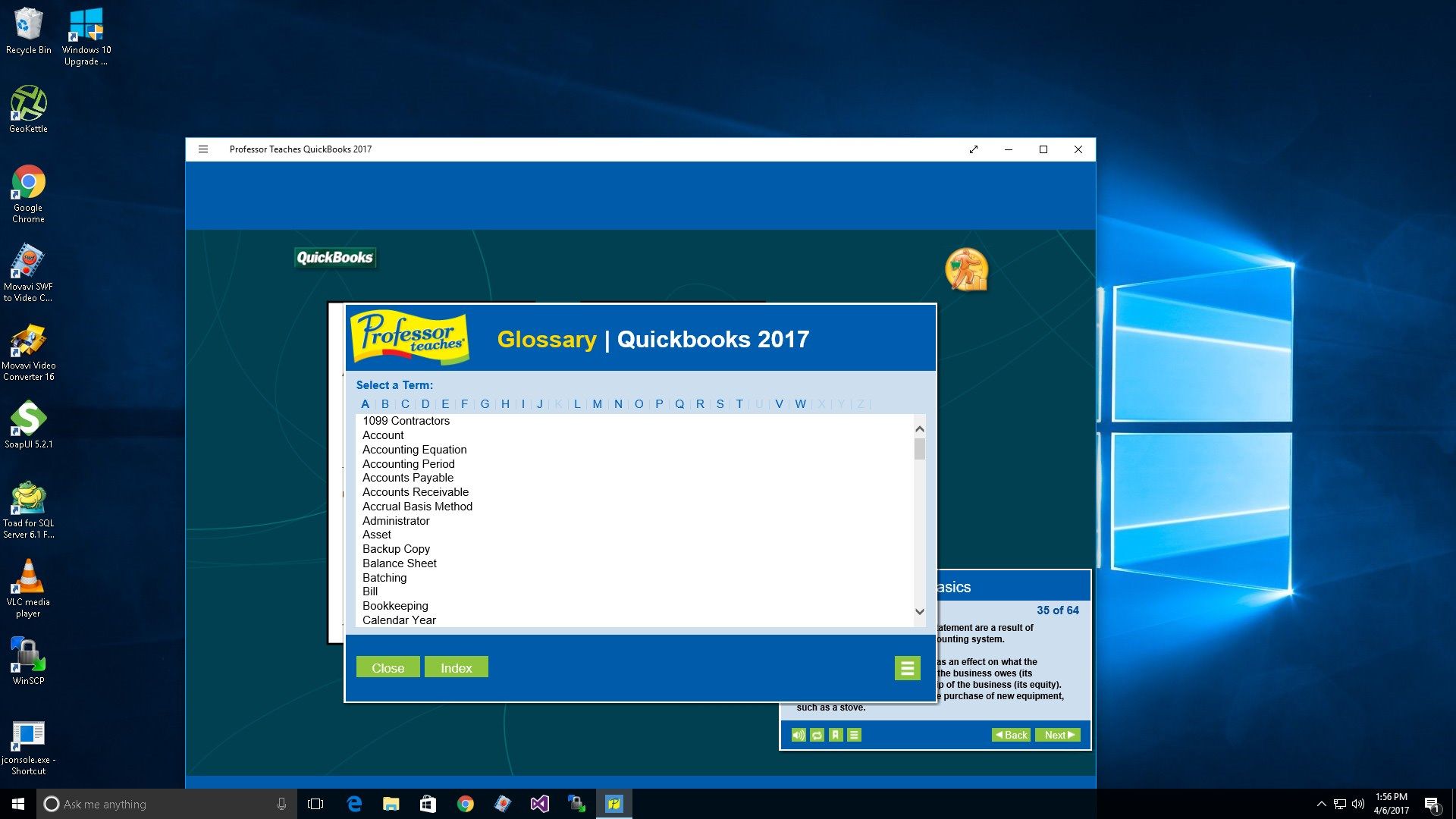

Glossary, Index, and Search