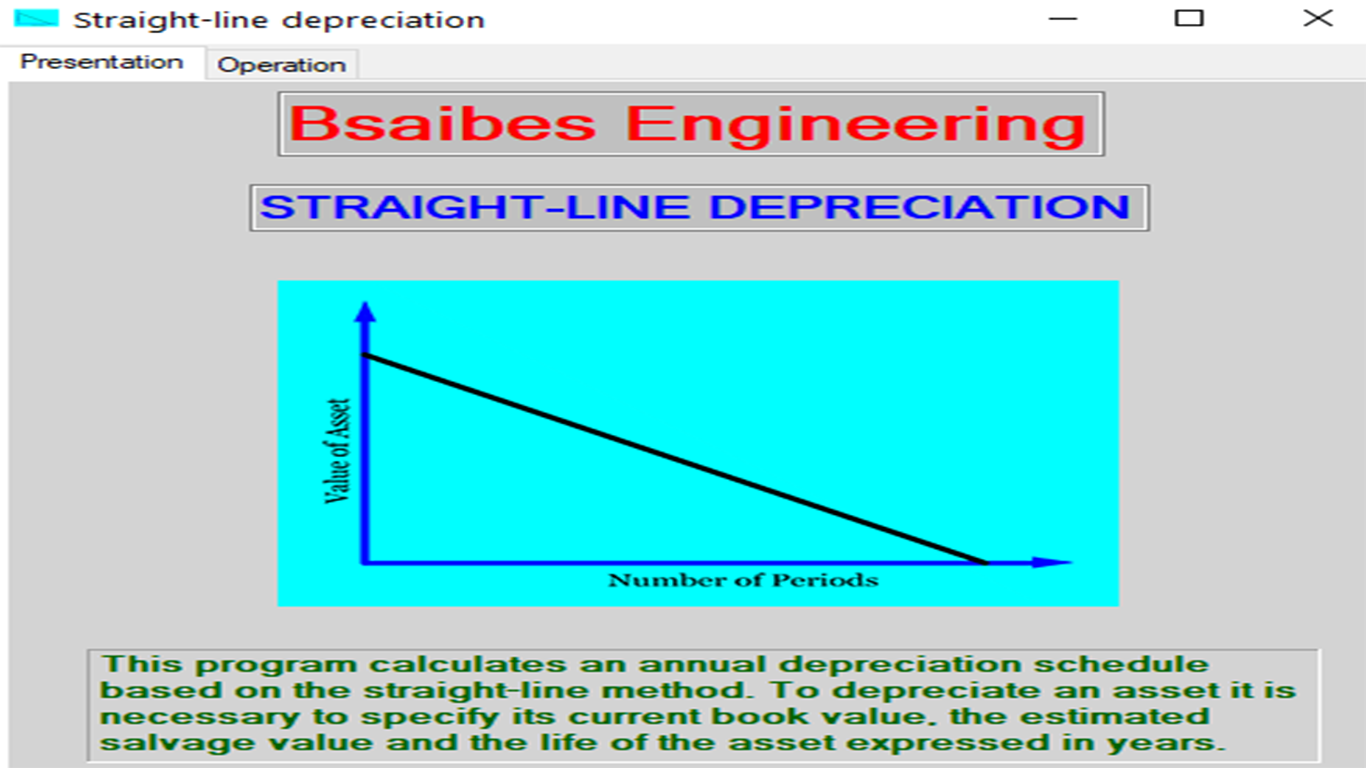

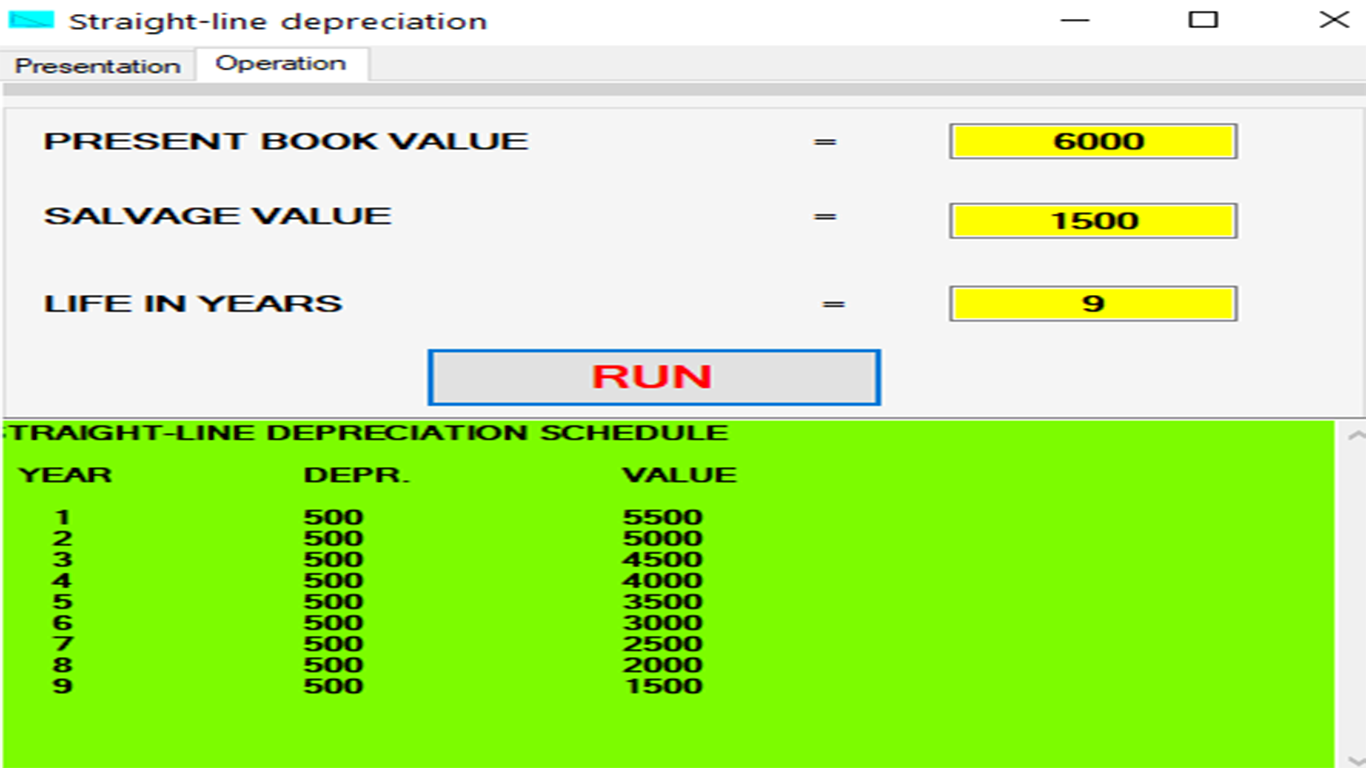

STRAIGHT-LINE DEPRECIATION SCHEDULE

Reviews:

0

Category:

Business

Description

This program calculates an annual depreciation schedule based on the straight-line method. To depreciate an asset it is necessary to specify its current book value, the estimated salvage value and the life of the asset expressed in years.

Product ID:

9P38T89H2N84

Release date:

2022-01-20

Last update:

2022-03-11