Debt Tracker

Rating

4.1

Reviews

99

App details

About Debt Tracker

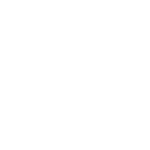

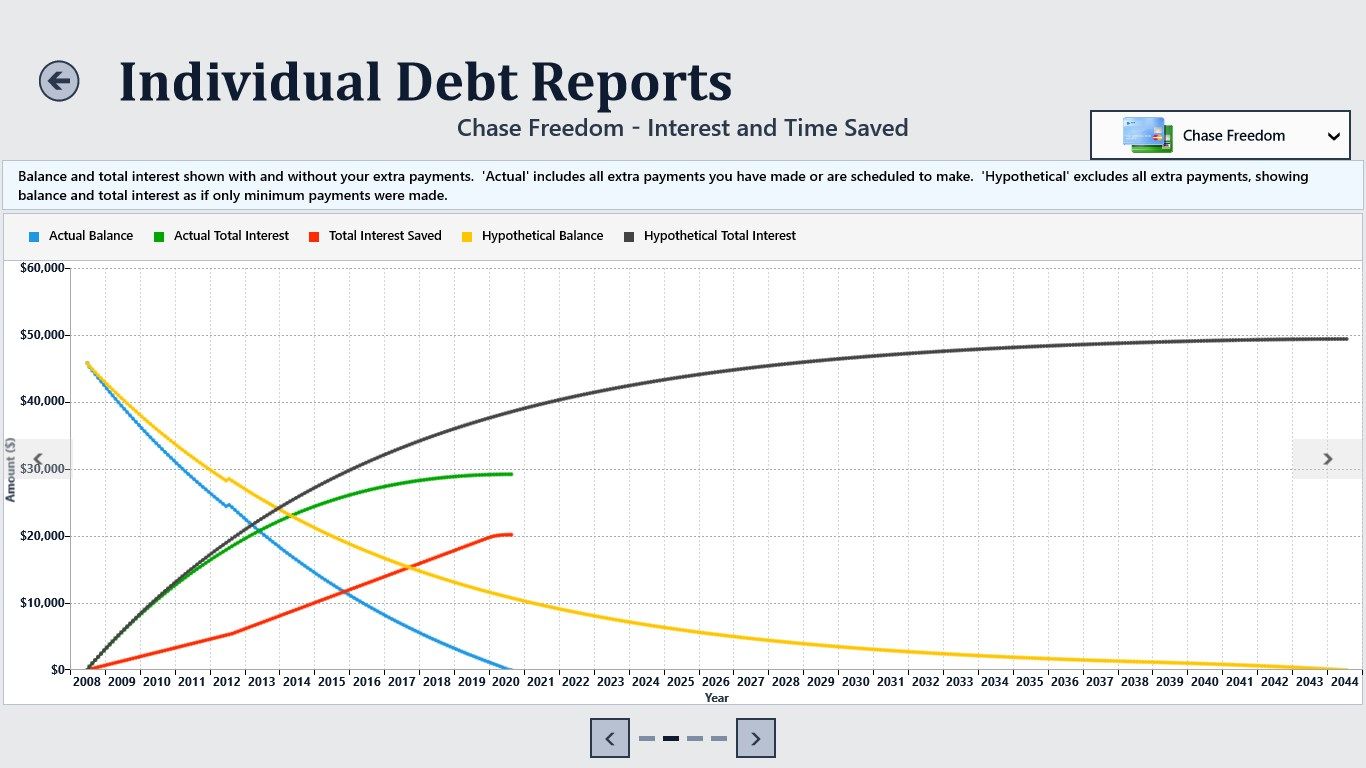

- Ever wonder exactly how much an extra payment you made and/or are considering making will save you in interest? Want to see interest savings as a result of each and every individual payment transaction? Interested to know how much you’ve saved so far and to see projected future savings?

- Want to see individual and combined views of all your debts in one place? View payoff progress, how much earlier you’ll pay off debts due to extra payments, your overall balance or interest paid and saved at any point in time?

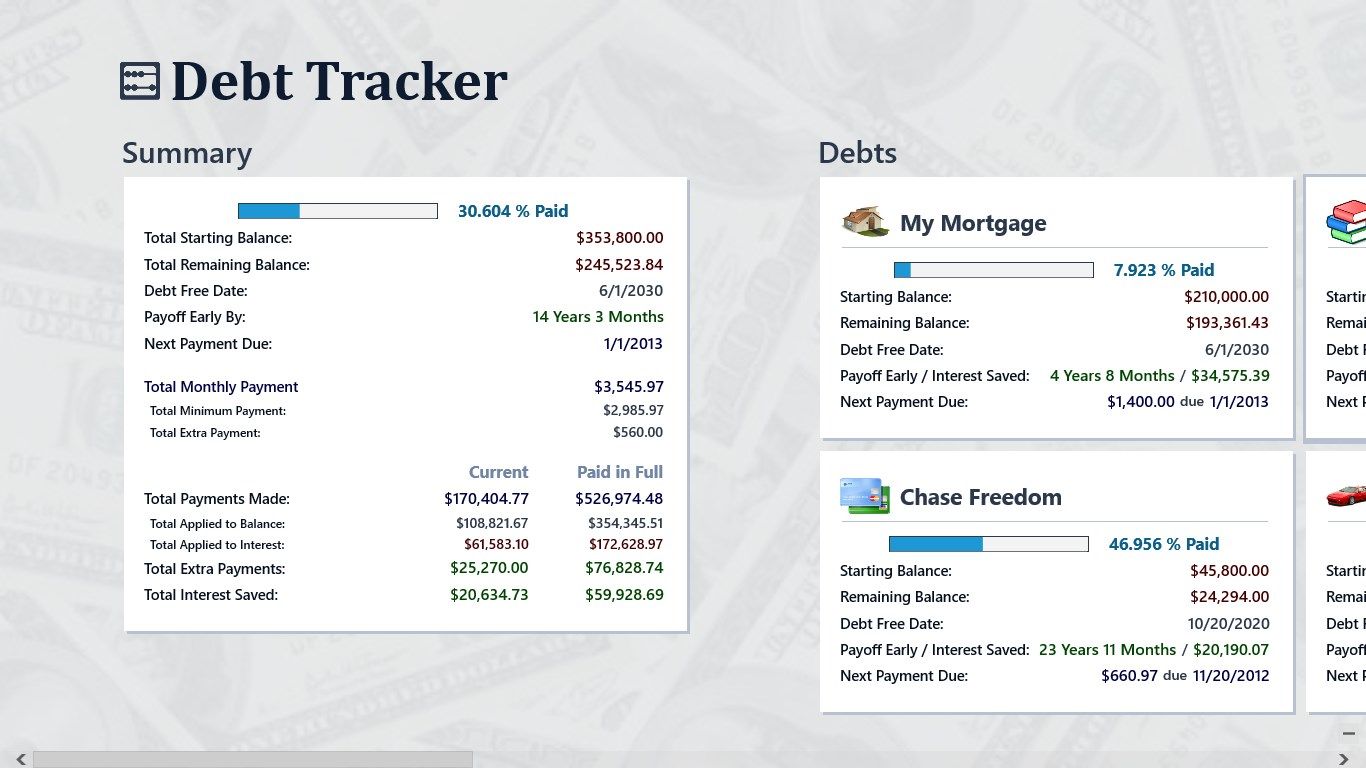

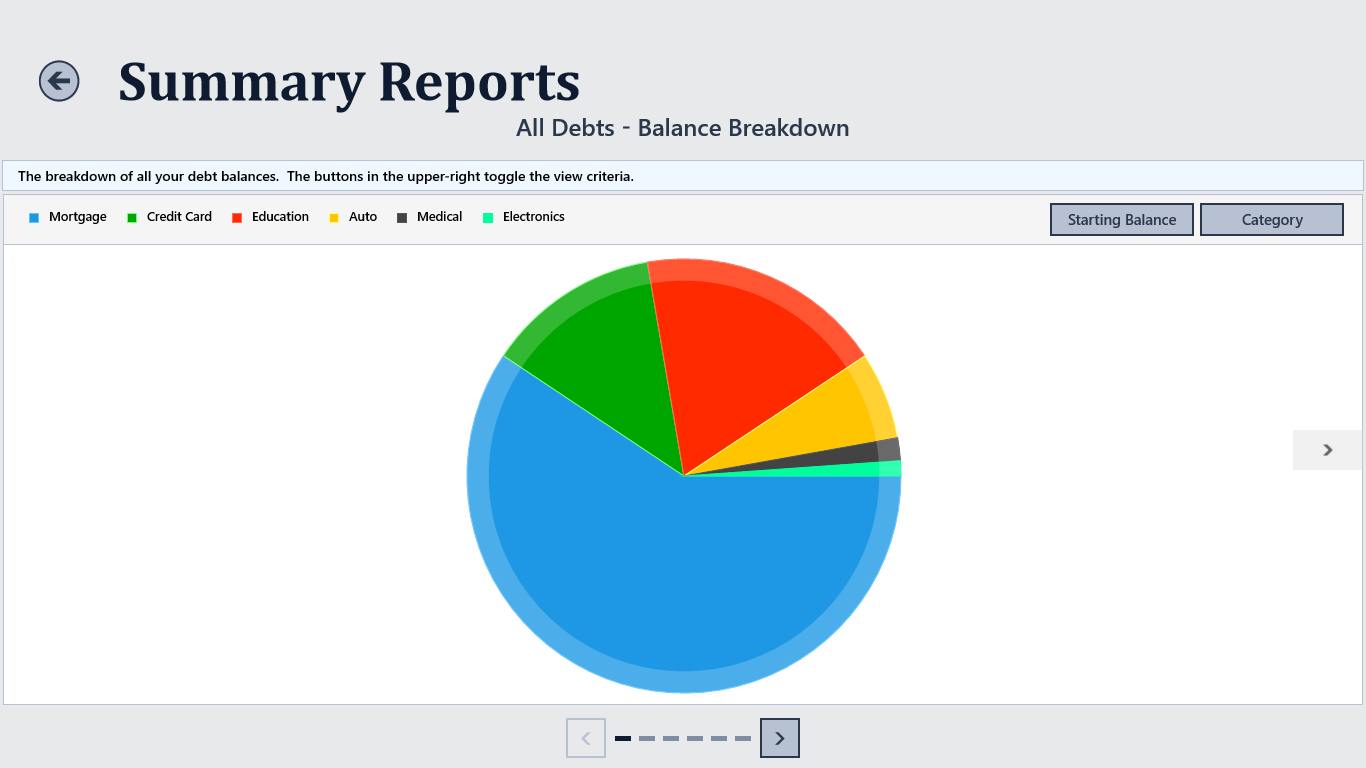

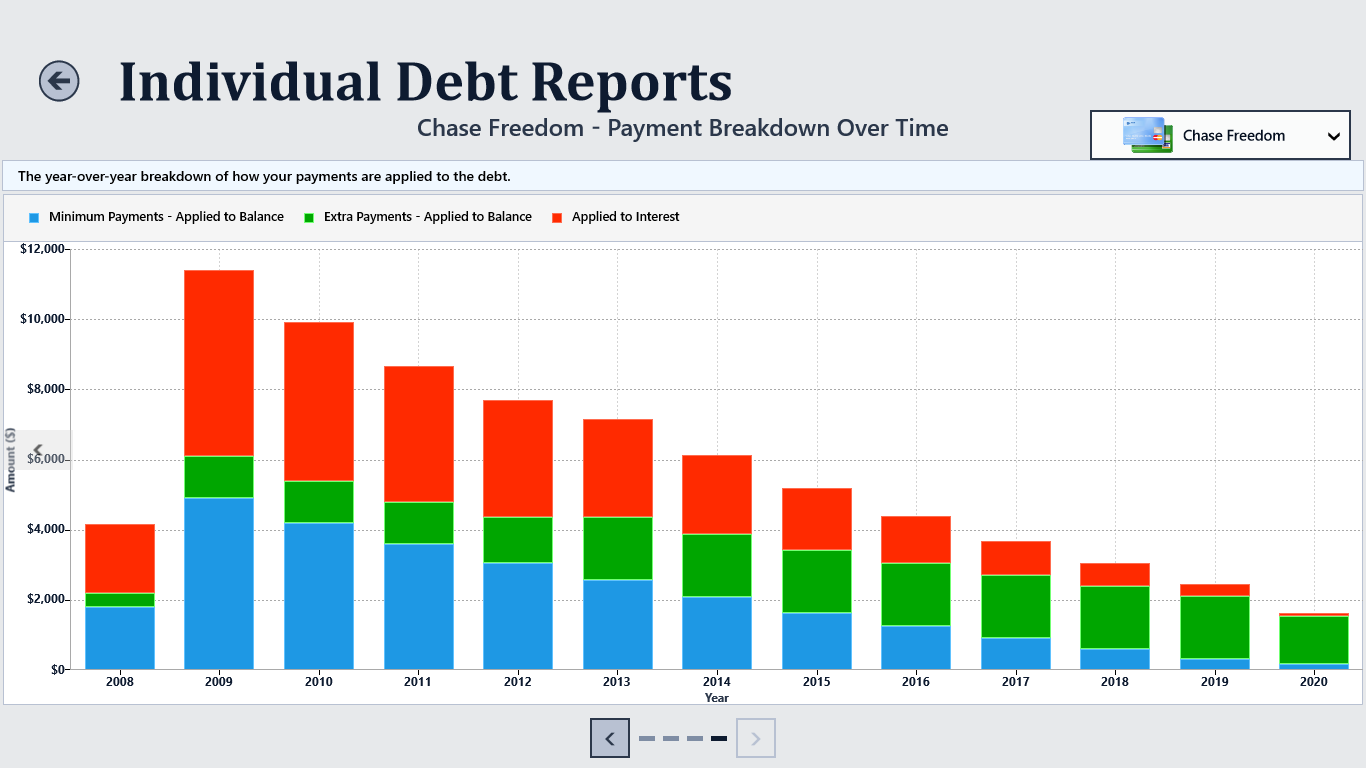

- Would you like analyze your personal debts in charts showing year-over-year payment breakdowns, balances, interest and time savings?

- Want more control than the standard mortgage/loan calculators on the web? The ability add/edit transactions in the payment schedule, change interest rates or extra payments at any time over the life of the debt?

Debt Tracker is a powerful and easy to use tool that puts you in control of your debt. Debt Tracker allows you to easily track and analyze all your debts in one place, including installment loans (mortgages, auto loans, etc.) and revolving credit (credit cards). Track your payoff progress in Debt Tracker as you check off monthly payments, visualize individual debt metrics or your overall debt picture in powerful charts, brag about how that one payment earlier this year saved you thousands of dollars in interest!

Try Debt Tracker risk free with a 7 day full-featured trial!

Key features

-

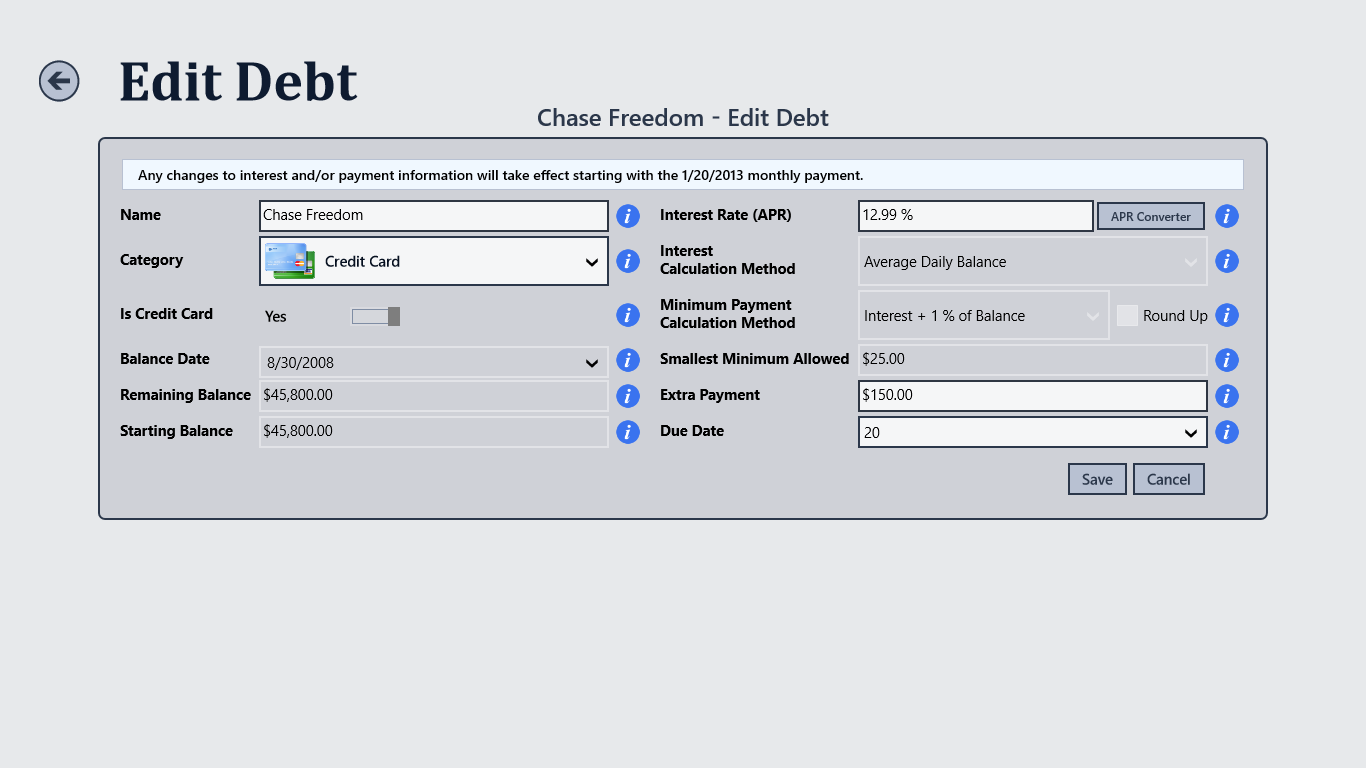

With minimal input Debt Tracker will setup a standard payment schedule as a starting point, and from there you are in total control.

-

Each month you can quickly record the standard payment, or edit the payment info before recording.

-

Edit interest rate, minimum/extra payments as you progress through the payment schedule to support scenarios like variable interest rates, changing extra payment amounts as your budget changes.

-

Add future or one-time extra payments, allowing you to try out “what if” scenarios to see how much you could save.

-

Add balance adjustments, or purchase/credit transactions to keep Debt Tracker up to date and accurate.

-

For mortgages/loans, Debt Tracker supports standard monthly compounded interest, along with daily and semiannual compounding (e.g. Canadian Mortgages).

-

For credit cards, Debt Tracker goes way beyond typical debt tools available today by supporting the actual calculation methods creditors use to determine monthly interest and minimum payments.

-

Ultimately this means you don’t have to hassle with entering these values each month and instead Debt Tracker will compute them for you along with more accurate interest savings projections.