Mortgage Calculator

App details

Release date

Invalid DateTime

Last update

0001-01-01

Product ID

XPDC0TBKWR3JSV

Categories

Personal financeAbout Mortgage Calculator

Contact [email protected] for questions, comments and suggestions.

This easy and simple to use mortgage calculator can be used to accurately estimate your monthly payments. Analyze multiple scenarios such interest rate increase and save money by making an informed decision.

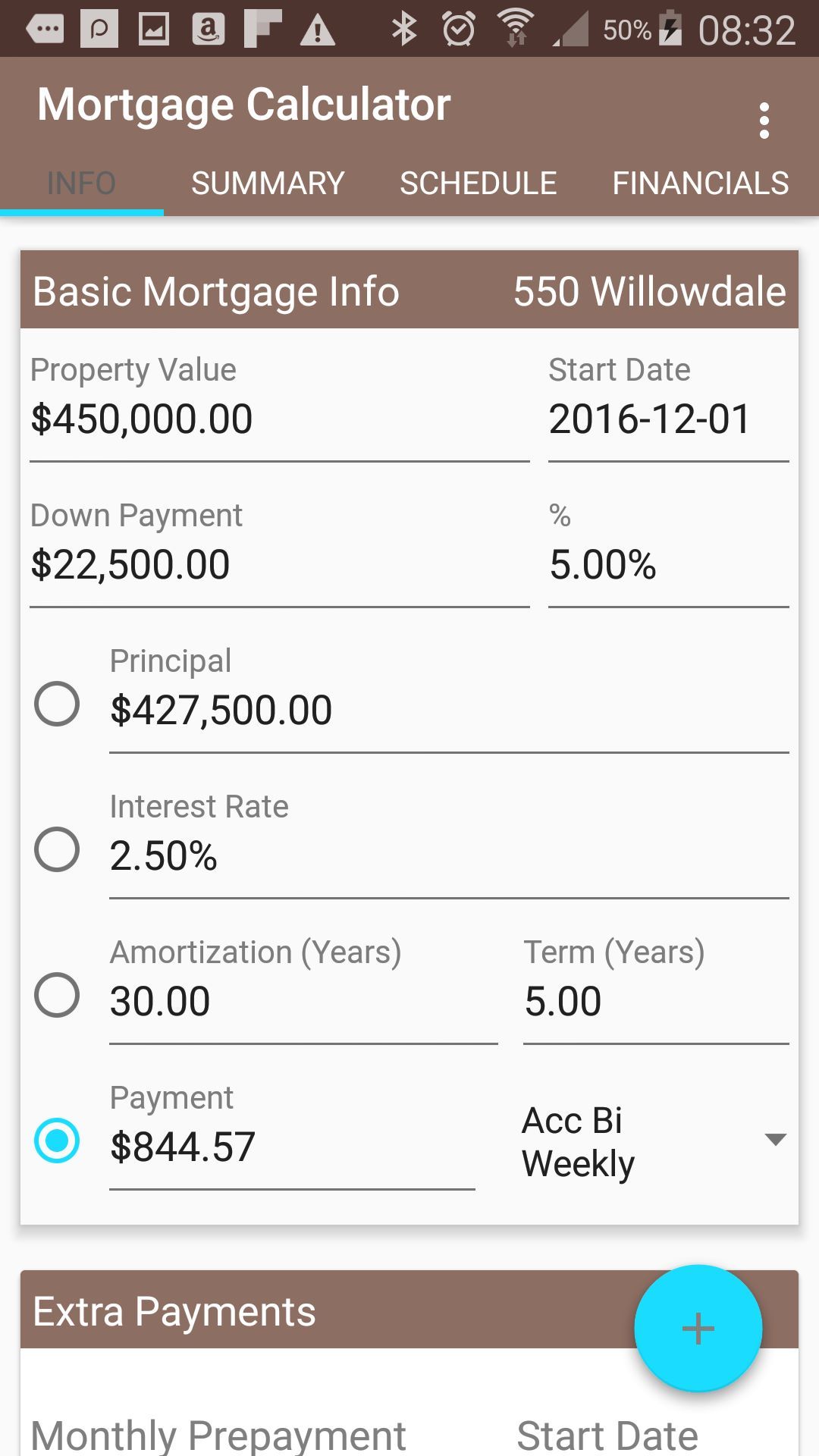

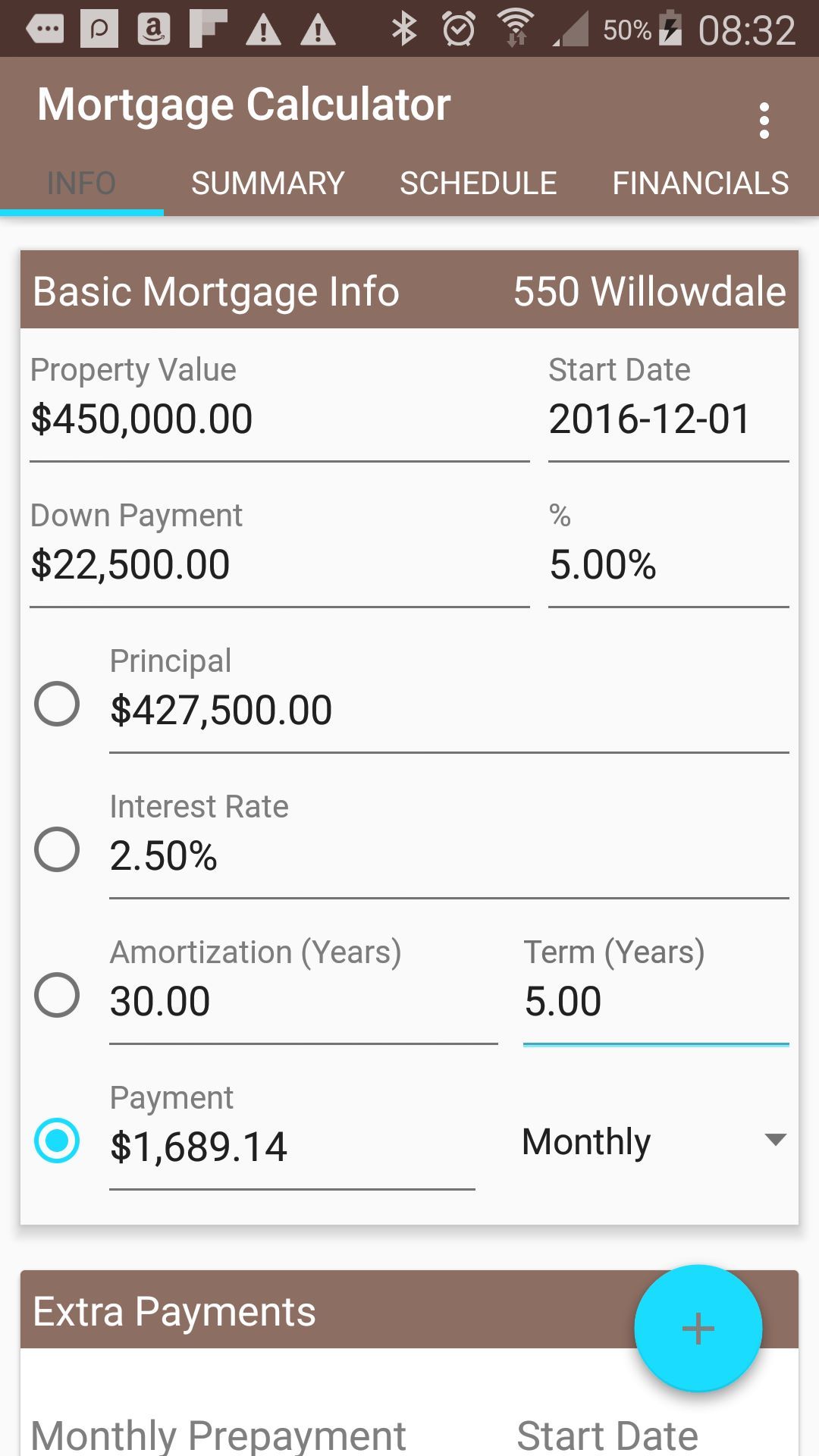

In simple mode, just enter the value of property, down payment (deposit) amount, interest rate , amortization period and instantly get an estimate of monthly payment amount. Change your payment frequency to accelerated Bi-weekly see how much you can save.

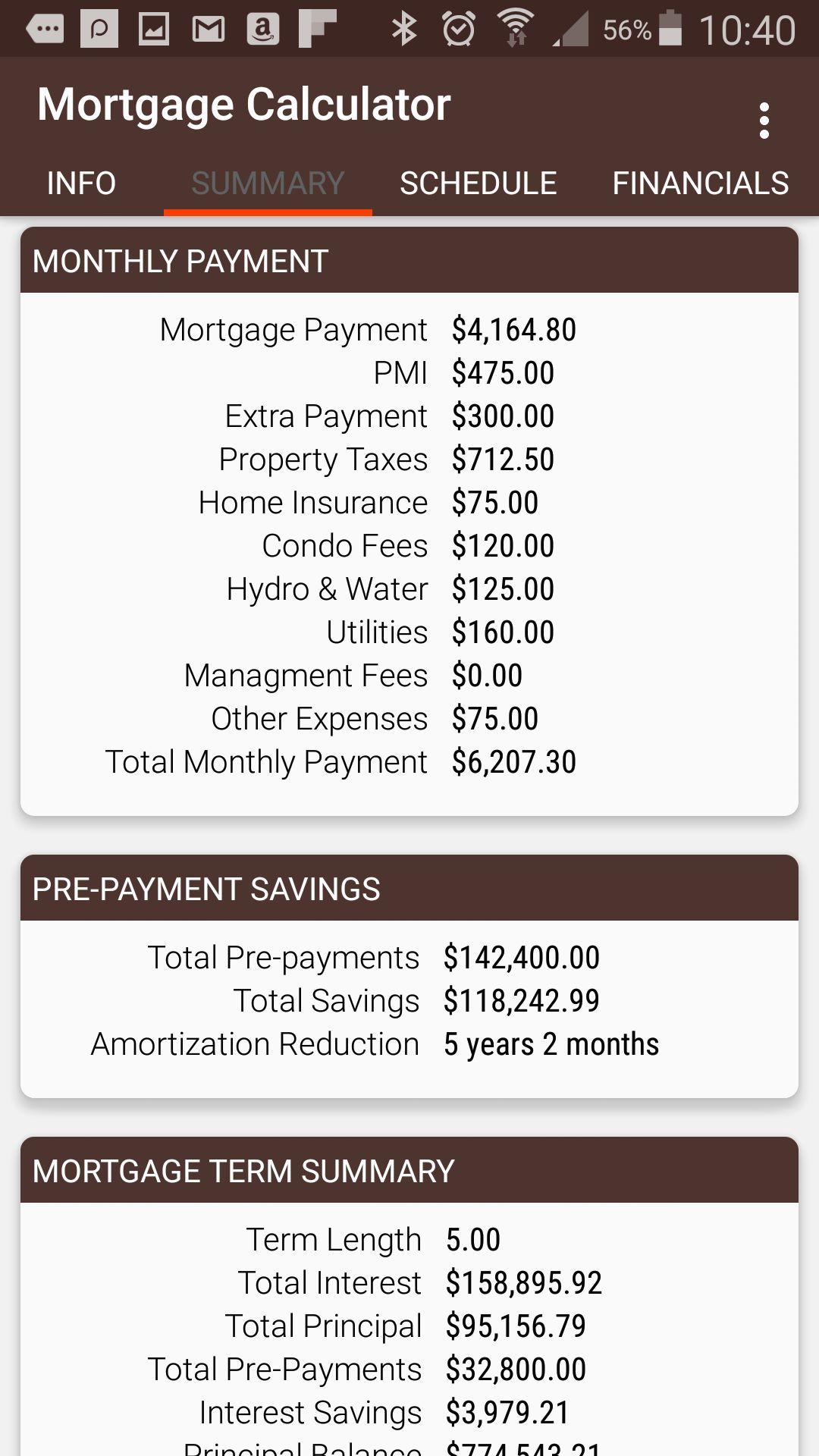

Add more information, such as monthly extra payments see how much you can save in the interest cost and become mortgage free sooner. Are you on biweekly paycheck ? Then put some or all of the 3rd extra payment in the semi-annual prepayment and check out the interest saving.

Keep adding more information such as property taxes, PMI, homeowners insurance, utilities cost, homeowners association (HOA) cost to get a complete picture of the total cost of owning a home.

Thinking of buying a property as an investment property. Use the Financial analysis module to estimate the financials of a property deal. This calculator can estimate most of the popular metrics such as ROI, Cash on Cash, IRR, NPV, Loan to Value , Break even ratio, cap rate, DCR and many more. Analyze the deal over the life of the property. NOTE: The financial calculator does not take taxes into consideration.

Create multiple mortgage profiles for different scenarios and see the effect of interest increase, changing down payment amount, changing frequency of payment and many others. Instantly compare different mortgage scenarios and make a wise decision that can save you thousands of dollars in home ownership cost.

You can also perform some simple reverse mortgage calculations such as estimating your mortgage term if you increase your mortgage payment by $100. On the first (Info) tab the default target calculation is “Monthly Payment”

You can select any of the other mortgage variables such as “Interest Rate” , “Principal” or “Mortgage Term” to reverse calculate that value.

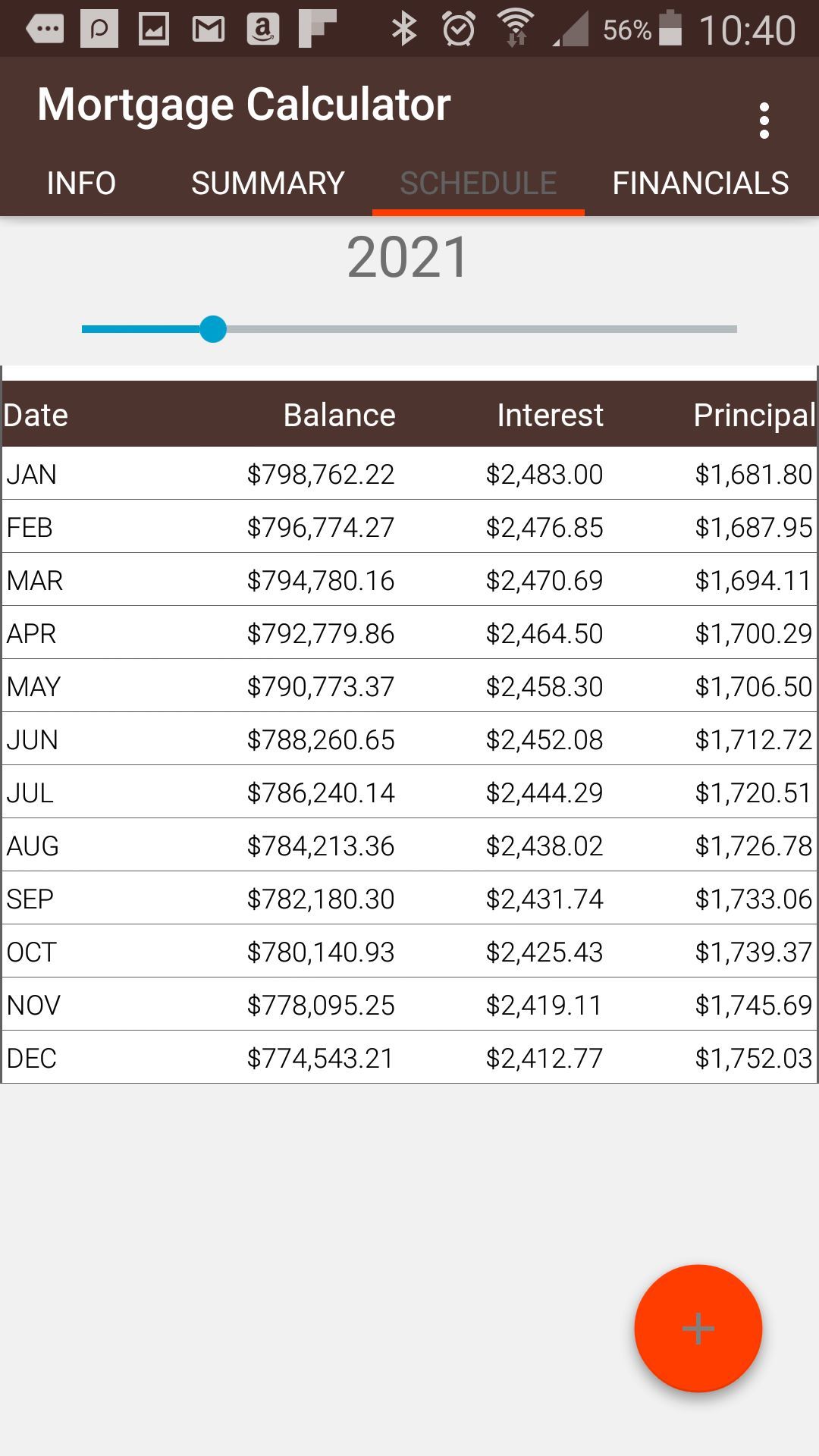

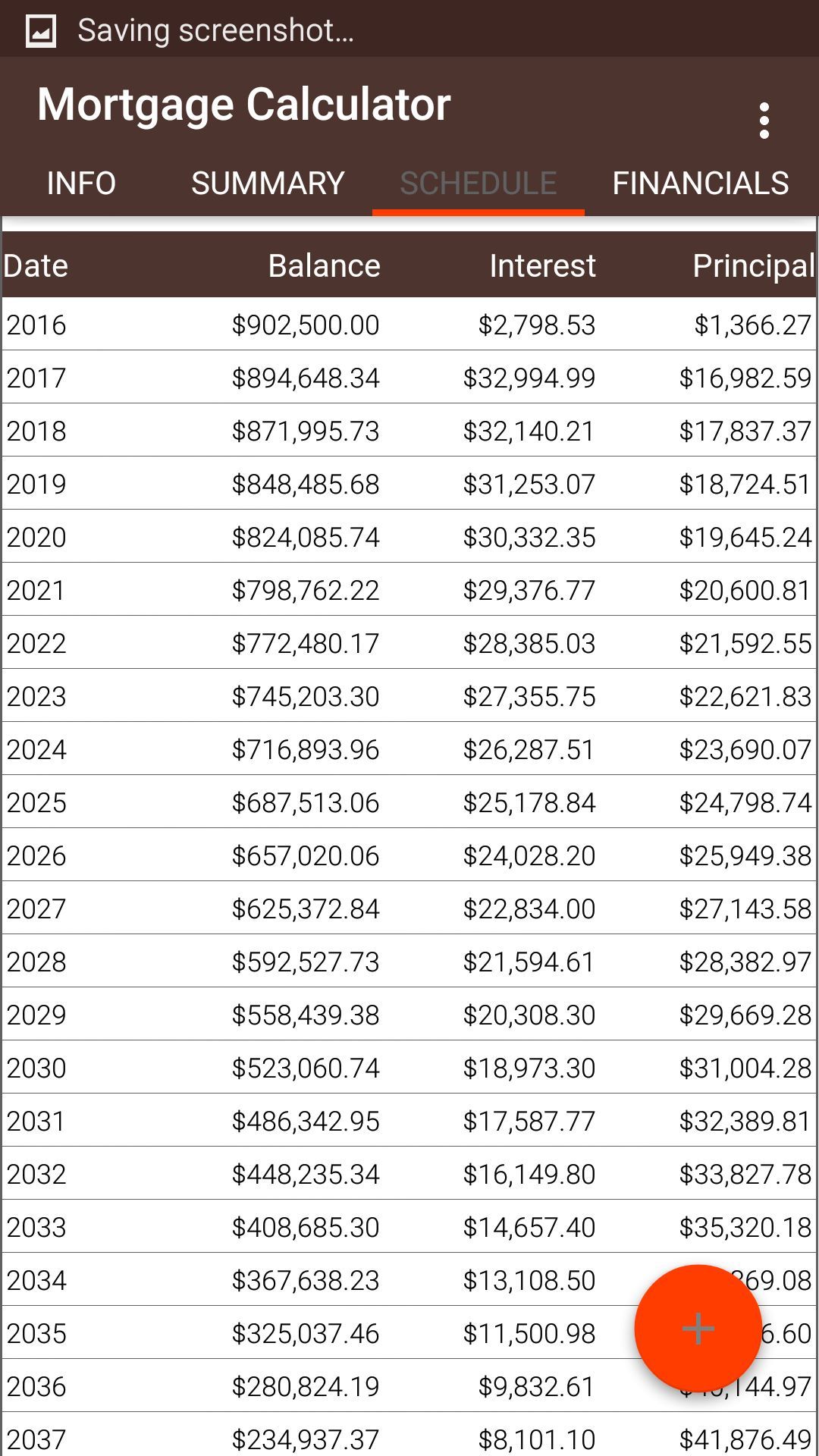

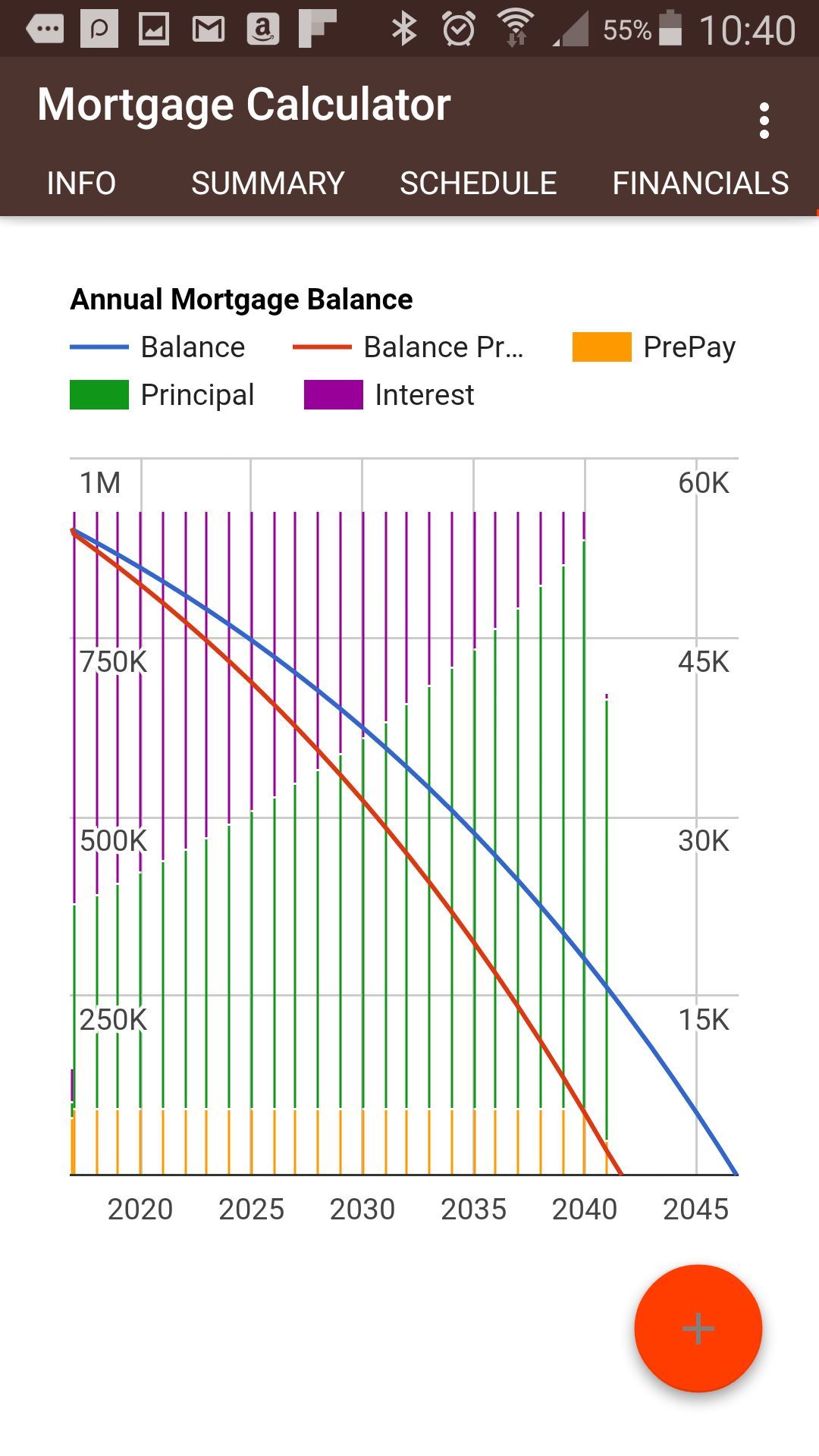

The result is presented in tabular as well as graphical format. Tabular results are presented under the Schedule tab; Annual payment schedule gives your total interest payment and principal payment per year. The full schedule table gives the complete mortgage payment schedule by month.

Use the calculator to answer common questions such as

- What will be my mortgage payments given the property cost, interest rate and term of amortization.

- How much can I afford to pay for a property for a given monthly payment, interest rate and term value.

- How long will I take to pay off my mortgage if I increase my payment by $100 or $200.

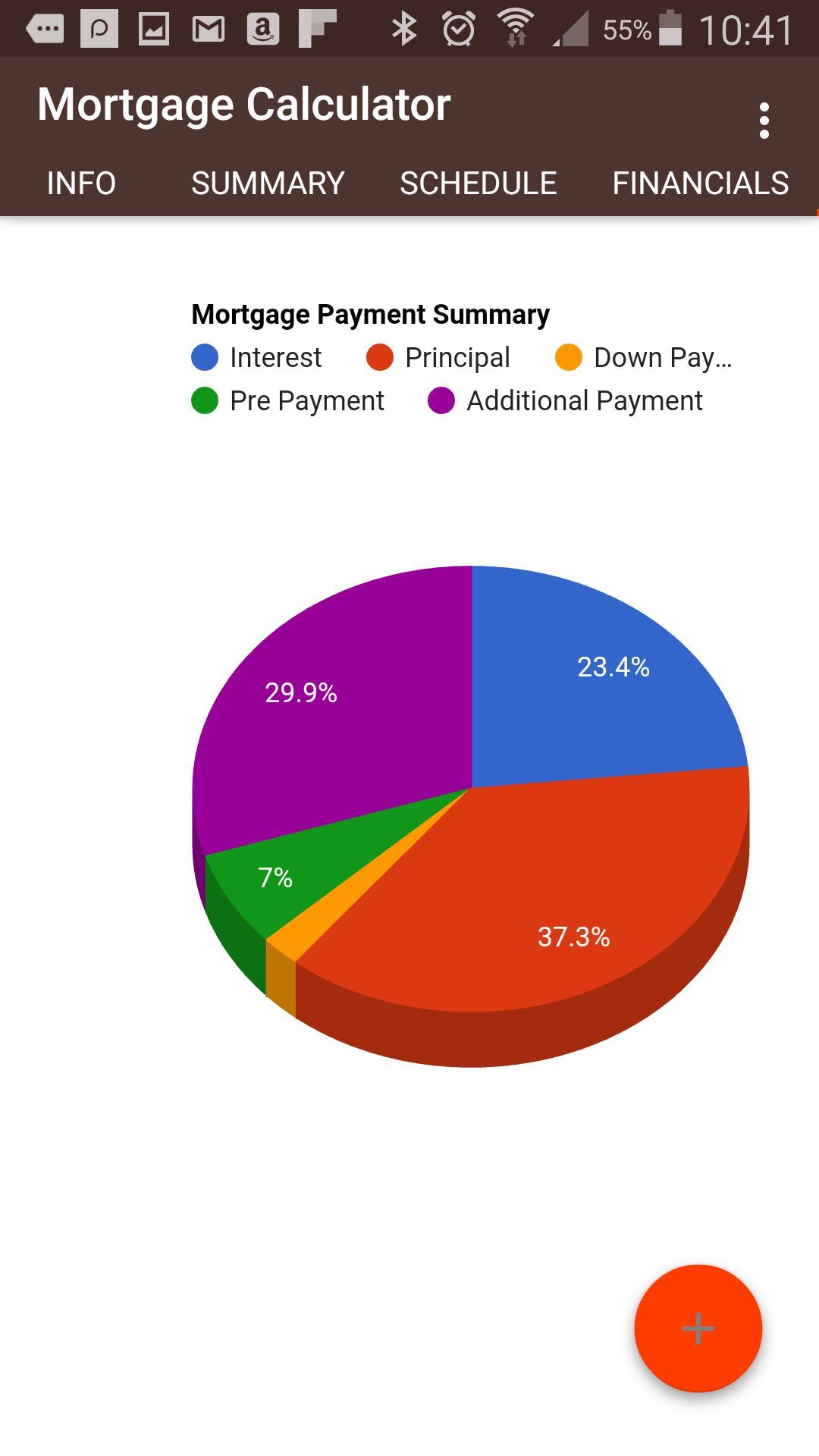

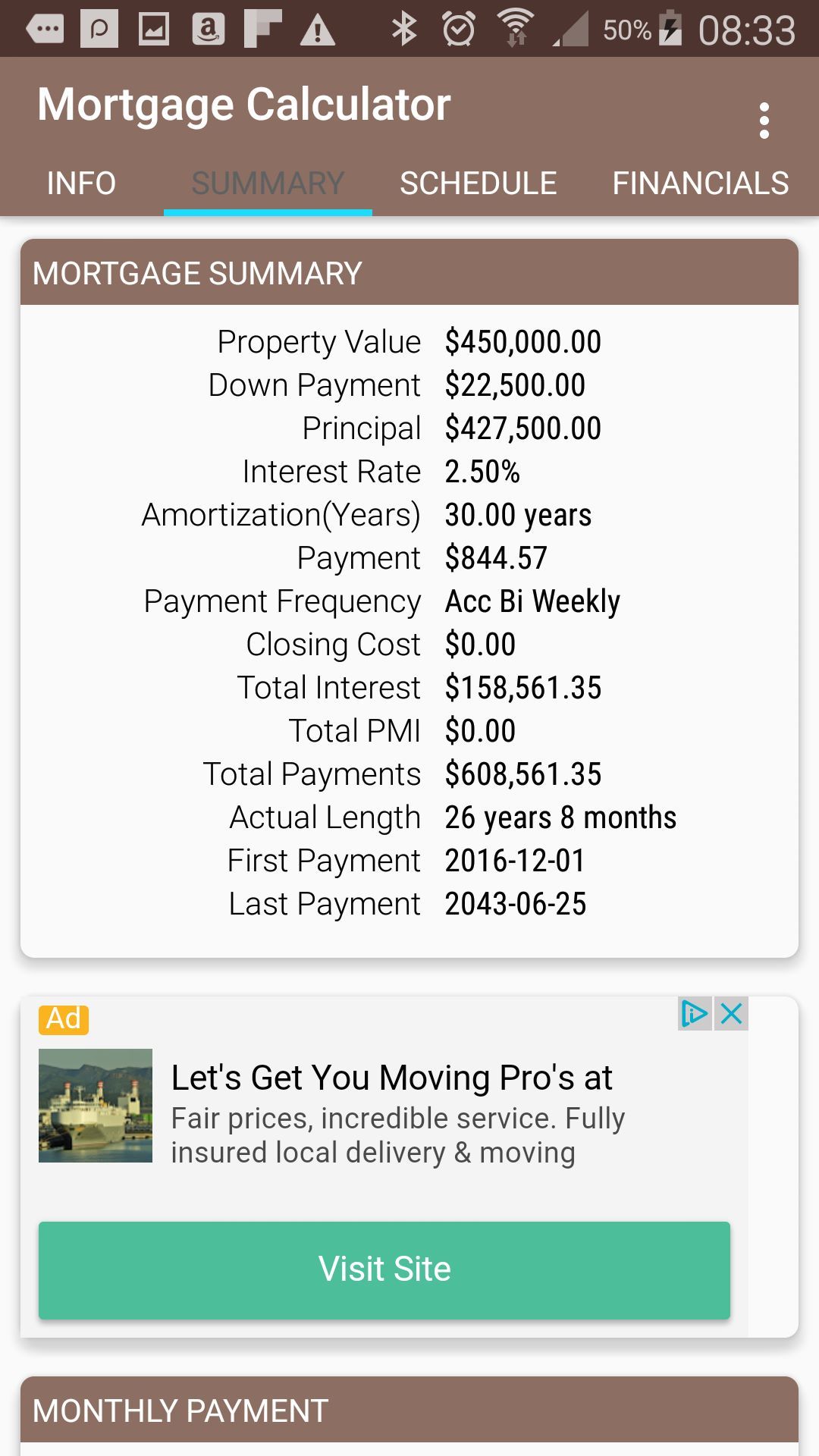

The summary tab gives the mortgage summary which gives the total interest paid, mortgage start and end dates and total payments. In this version the interest rate is compounded on a monthly basis. Use this as a home loan calculator.

This calculator should be used for general calculations purposes only and not for making any financial decision. Each country / financial institutions have different rules and regulations around mortgages which are not reflected in this calculator. Please consult your financial institution or mortgage broker to get a complete picture of your Home buying process.

This app uses Google Analytics to collect anonymous app usage data which is used by us to improve the app and aid in the development process. You can turn is off in the setting section of the app.

Key features

-

Calculate mortgage payments

-

Multiple payment schedule monthly, biweekly, weekly, accelerated biweekly extra

-

Calculates interest savings and time savings on making extra payments

-

Estimate other housing related costs such as utilities, taxes, maintenance etc to get the complete picture of home owership

-

Investment rental property financial analysis. calculate most of the ratios such as ROI, IRR, NPV, DCR, cash on cash etc