Paymentzilla

App details

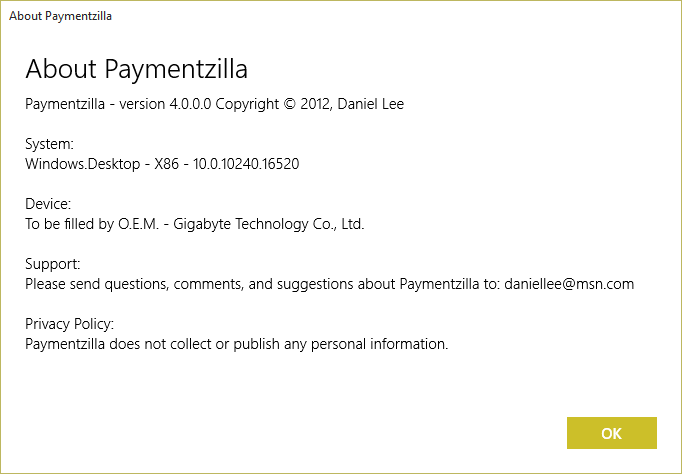

About Paymentzilla

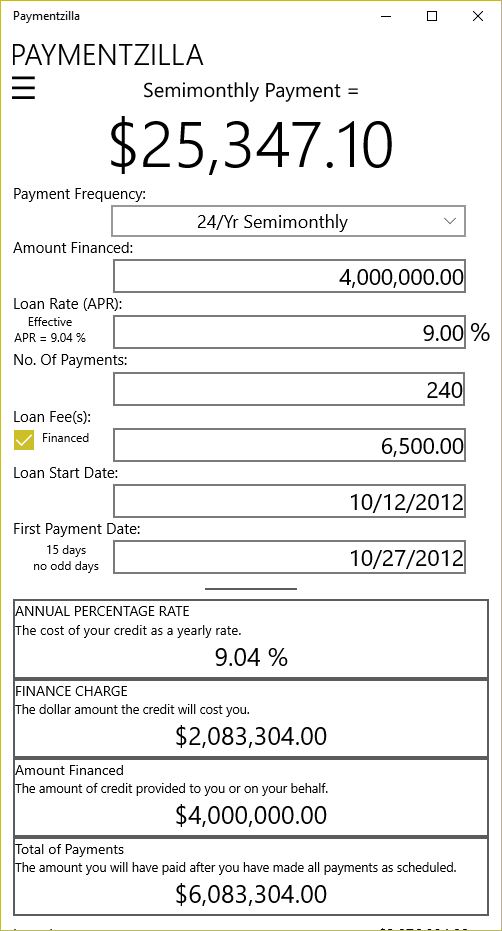

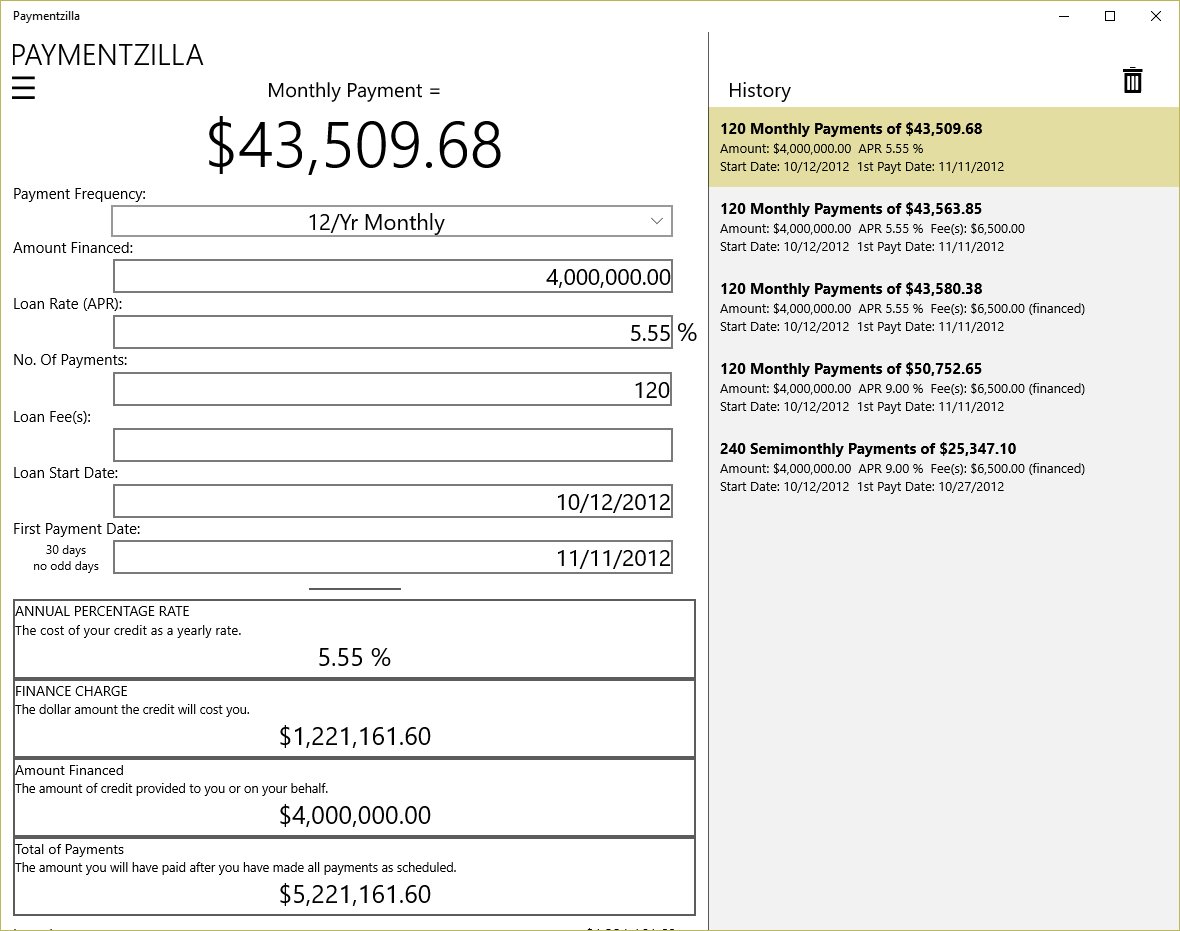

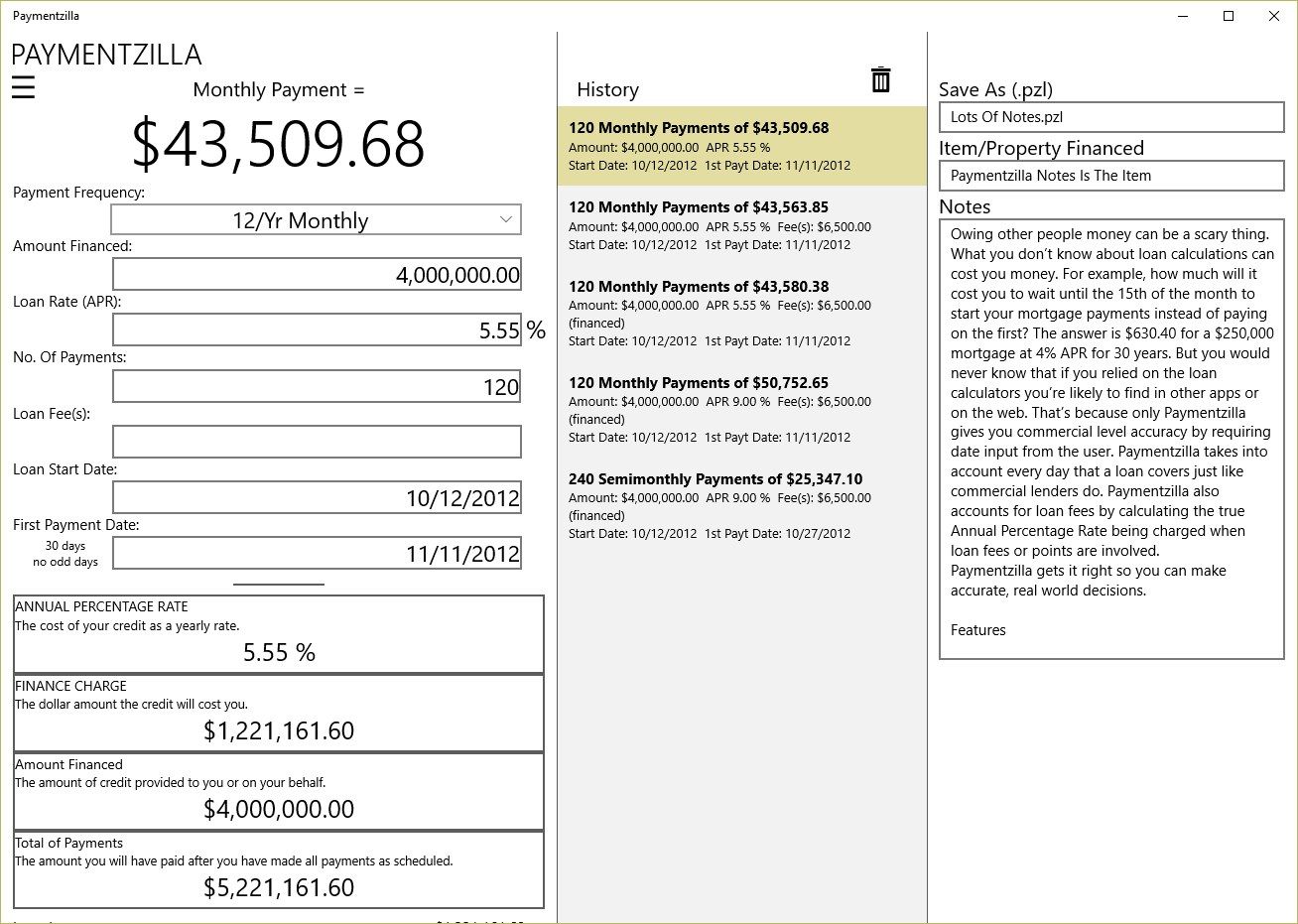

Owing other people money can be a scary thing. And what you don’t know about loan calculations can cost you money. For example, how much will it cost you to wait until the 15th of the month to start your mortgage payments instead of paying on the first? The answer is $630.40 for a $250,000 mortgage at 4% APR for 30 years. But you would never know that if you relied on the loan calculators you’re likely to find in other apps or on the web. That’s because only Paymentzilla gives you commercial level accuracy by requiring date input from the user. Paymentzilla takes into account every day that a loan covers just like commercial lenders do. Paymentzilla also accounts for loan fees by calculating the true Annual Percentage Rate being charged when loan fees or points are involved.

Paymentzilla gets it right so you can make accurate, real world decisions.

Key features

-

Nine different payment frequencies from weekly to monthly to annual payments

-

Odd days to first payment calculation

-

True/Effective APR calculation

-

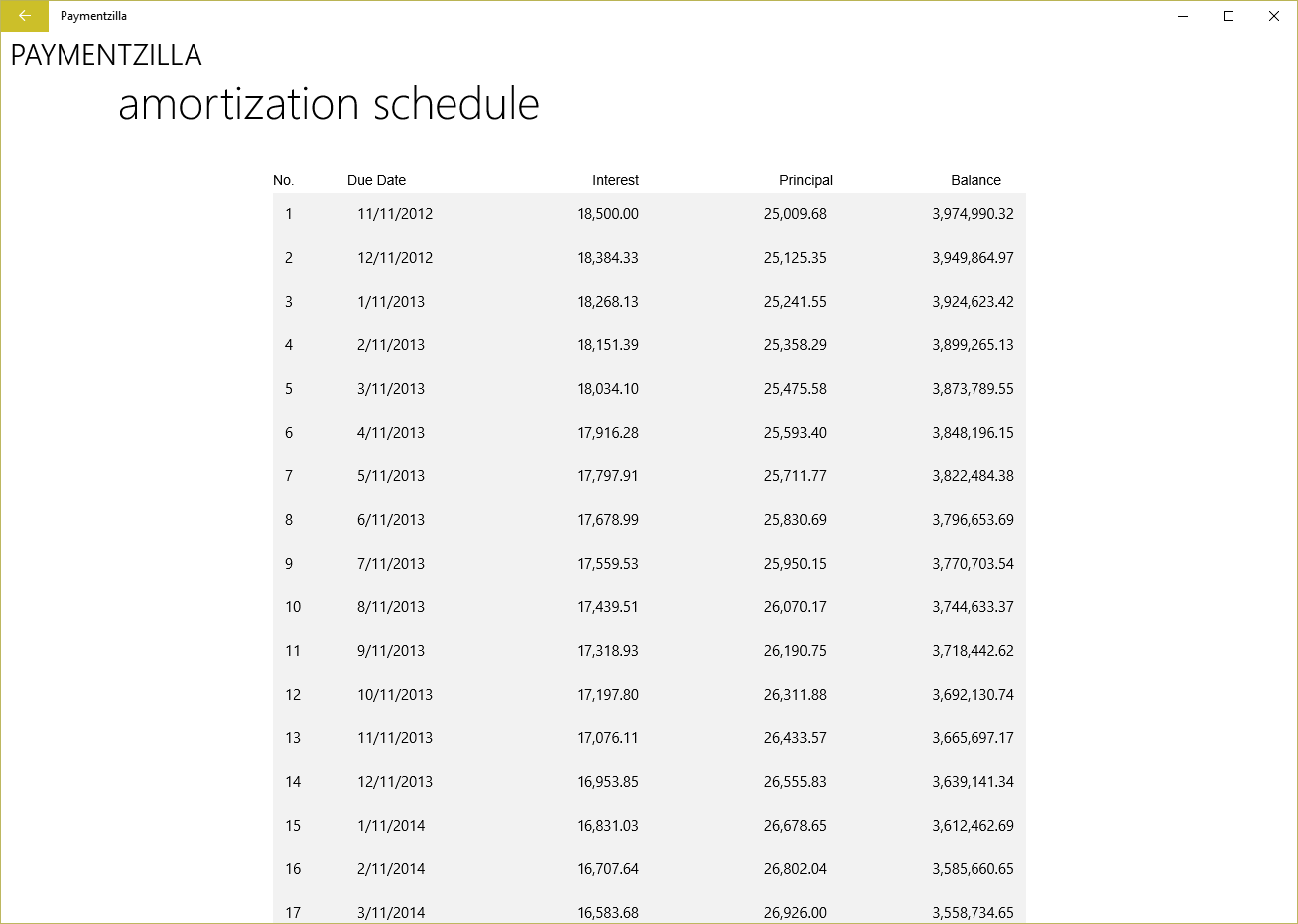

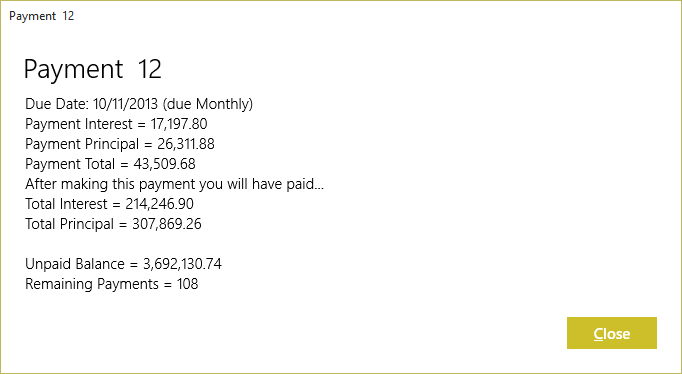

Amortization schedule

-

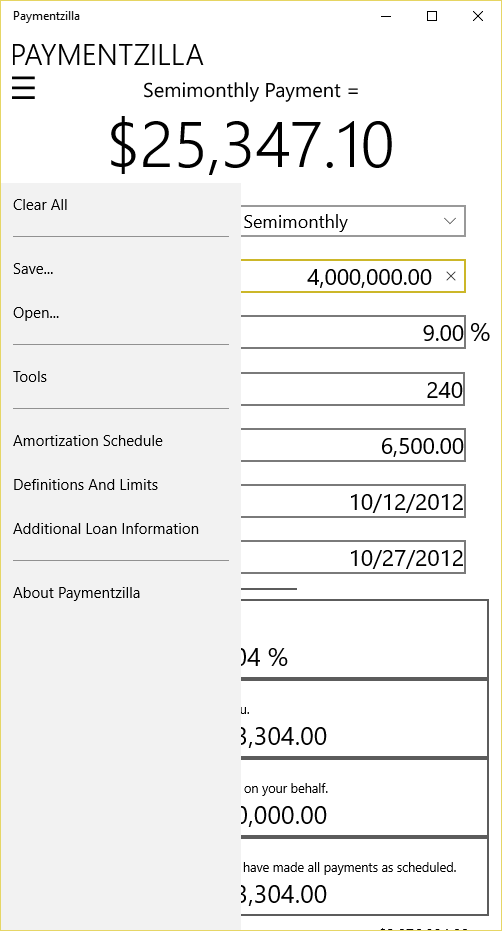

Save and recall loan files (.pzl)

-

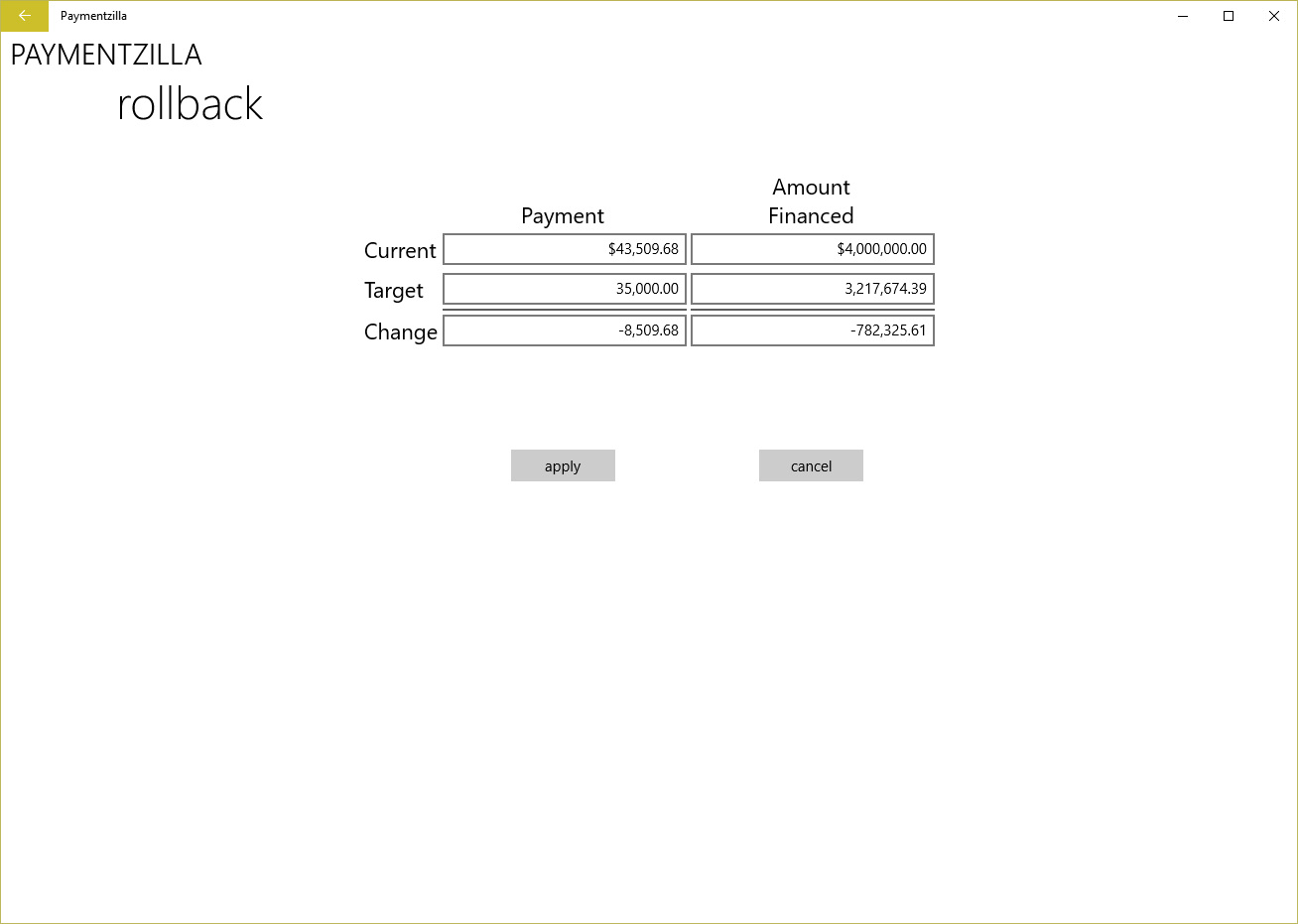

Rollback Calculators

-

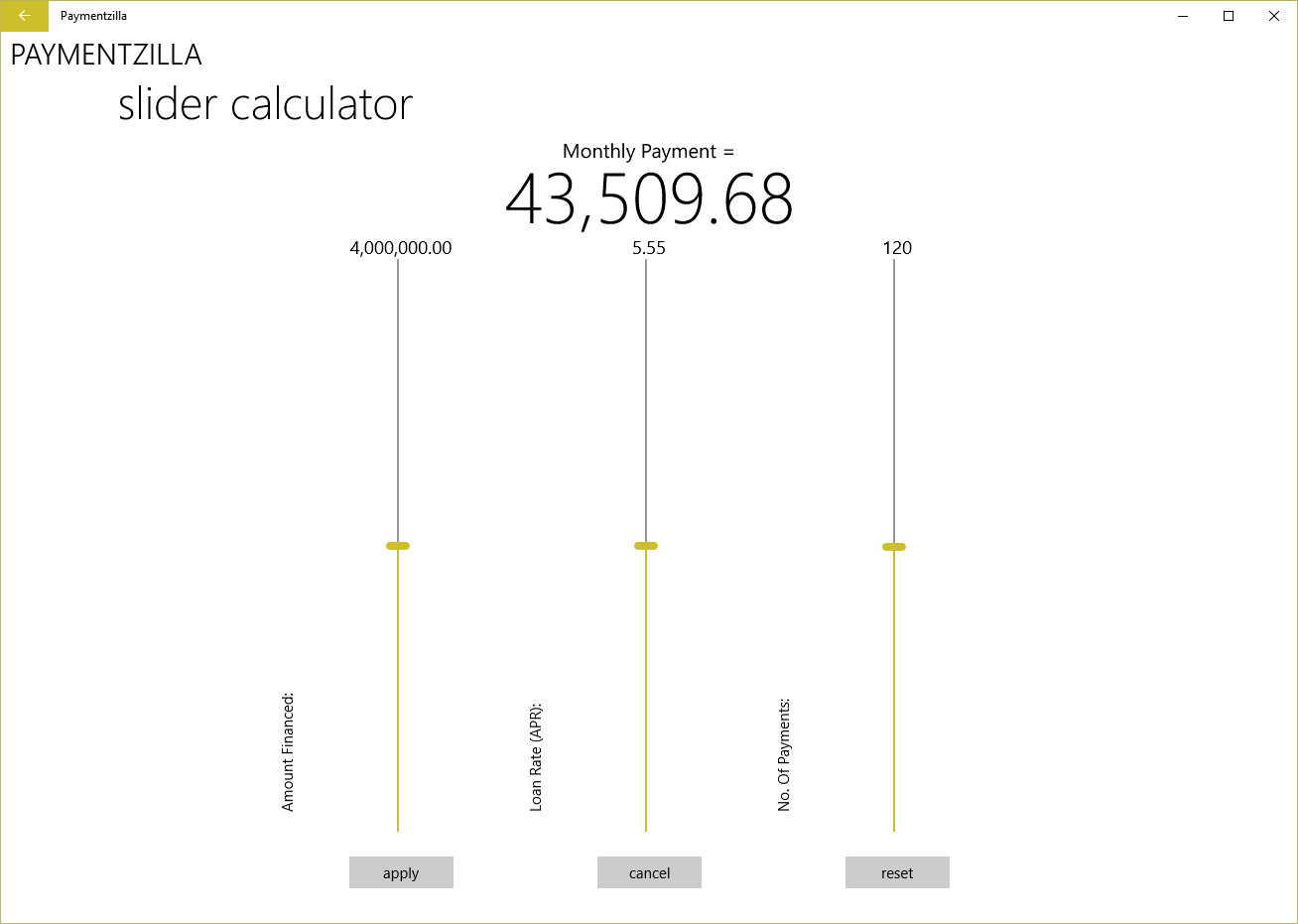

Slider Calculator

-

Globalized Dates and Currency Amounts